Stocks close down amid trade war concerns; BoC delivered a hike and promised more

Wall Street closed the day with losses as investors are concerned about the trade war; on the other said, the Bank of Canada raised its interest rate as expected, and deliver an optimistic outlook. However, Trump’s new tariffs eclipsed everything.

It is the war! The depressed reaction to Trump administration’s new tariffs on $200 billion worth of Chinese products showed how sensitive the market is to the trade conflict between the United States and the rest of the world.

The Dow Jones closed down 0.88% on Wednesday, stopping its 4-day winning streak. DJIA finished at 24,700.45, 219.21 points below the opening level. The S&P 500 declined 19.82 points, or 0.7%, on the day to close at 2,774.02.

The Nasdaq Composite finished the day 42.59 points, or 0.55%, down on the session to close at 7,716.61.

Most sectors finished the day down. Energy was the worst performer with a 1.48% decline; followed by telecommunication services with 1.09% losses, and the materials that were 1.08% down on the day.

Best performers were information technology with a 0.93% advance; consumer discretionary closed 0.37% positive on the day, and health care that was 0.08% up on Wednesday.

Bank of Canada raised the overnight rate and cited a growing economy

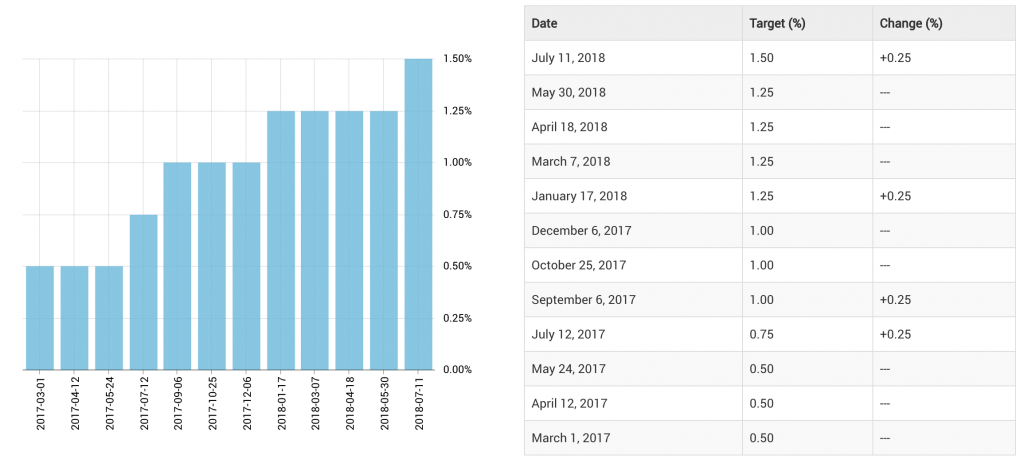

Policy Interest Rate Bank of Canada

The Ban of Canada raises its overnight interest rate from 1.25% to 1.50% on Wednesday as expected. The bank cited a growing economy, a healthy housing market and it provided a hawkish outlook for the Canadian economy.

BoC hinted that they would raise its inflation forecast for the second half of 2019 as they “expect that higher interest rates will be warranted to keep inflation near target.”

However, the BoC cited concern regarding the trade conflict around the world. It stated that Dollar strength is due to trade actions and the related concerns in the market. Also, trade tensions are containing funding and investing in some sectors.

The BoC will be monitoring trade developments, and it will take into account the reaction of companies and consumers.