Ethereum and Bitcoin move on consolidation pattern, but both at lows

Cryptocurrencies are under pressure these days as investors are watching how volatility is back on Forex and stocks are rallying in almost all developed countries. In the middle of a storm of regulation, hopes remain intact, but the deal is when is going to be the crypto time.

Ethereum is trading in consolidation mode after falling from 468.00 on July 30 to trade as low as 250.30 on August 14. After finding support at 250.30, the pair has been trading sideways in the last two sessions. Right now, ETH/USD is trading 1.47% positive at 285.30.

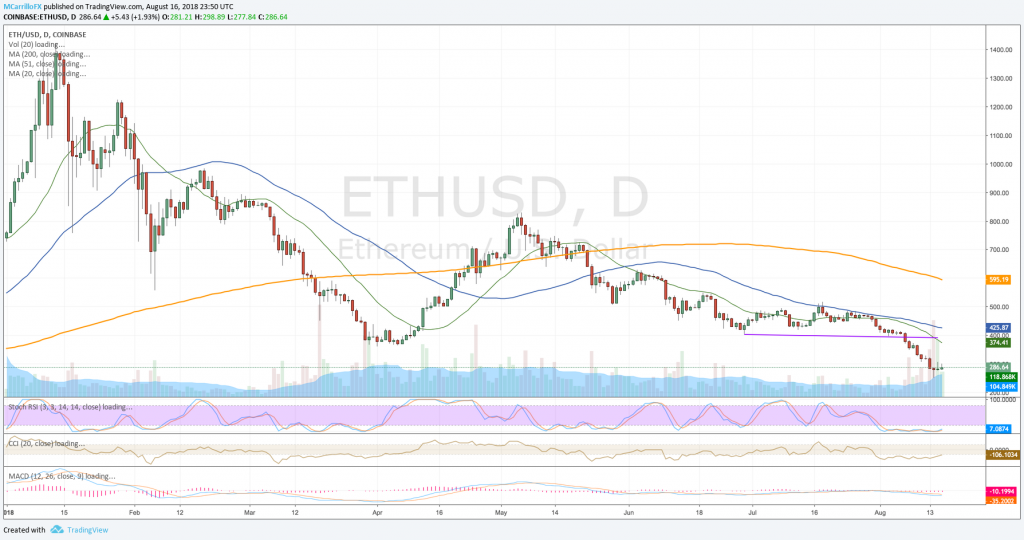

ETHUSD daily chart August 16

Technical conditions for Ethereum are weak, but indicators are improving its numbers. Moving averages in the daily chart are pointing to the south, while the pair seems trapped at the September-October-November 2017 range between 280.00 and 310.00. More to come.

To the upside, the pair needs to recover the 300.00 level and then to conquer the 320.00 area to spur bulls sentiment. Above that, the cross will find resistances at 365.00 and 400.00.

To the downside, immediate support is at 250.00, followed by the 200.00 area. Below there, check for 175.00 and 133.00.

Bitcoin remains weak, but at least it stopped loses

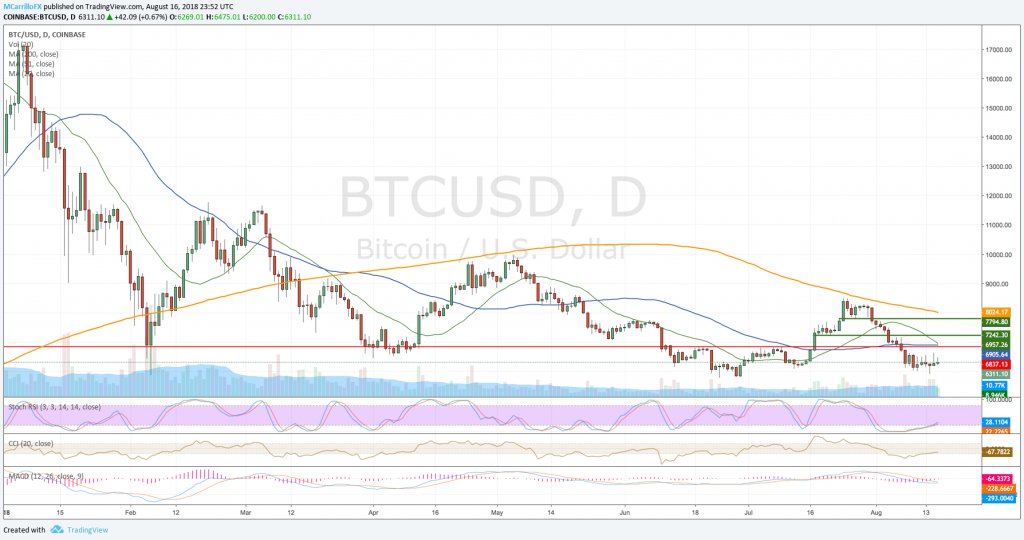

BTCUSD daily chart Agust 16

Bitcoin is trading near to August lows around 6,300 as the unit is moving somewhat up for the second day against the Dollar. The pair manages to keep above the 6,000 area tested last week, but it is contained by the 6,500 level.

BTC/USD is trading in consolidation mode after falling doom 8,465 on July 25 to trade as low as 5,900 on August 14.

FXStreet analyst Yohay Elam commented in a recent article that “the price of Bitcoin suffered a decline as July ended and August began. The move that was initially only an exit from oversold territory extended into a full-scale correction. The primary topic that buzzes through the crypto-sphere remains the prospects of an approval or a rejection of an Exchange Traded Fund (ETF).”

To the upside, the pair needs to clear up the mentioned 6,500 area and then it will find resistance at 6,840, 7,240, and 7,800. To the downside, if the pair breaks below the 6,000 area and extends declines beyond the 5,900 low, it will find supports at 5,800 and 5,500.