ADP reports more private jobs than expected; EUR/USD down

The United States company Automatic Data Processing, Inc, reported more jobs created in July than the expected by the market. EUR/USD is trading down, while the DXY is positive on the day.

According to the ADP, 219K new private jobs were created in July, more than the 185K new jobs expected by the market and an acceleration from the revised data of June. Checked up from 177K to 181K.

52,000 new jobs were created by small businesses with 1-49 employees; while midsize companies, between 50 and 499 employees, reported 119,000 new jobs; and large corporations created 48,000.

Most of the new jobs were created in the service-providing sector with 177,000 new private jobs. The goods-producing industry created 42,000 new positions. The only component that eliminated jobs was the information with a decline of 1,000 jobs.

Dollar index up for the second day ahead of key data

The Dollar index is trading positive for the second day as the DXY bounced at 94.15 on Tuesday to trade as high as 94.70 on Wednesday. DXY is currently trading 0.13% positive at 94.68.

Technical conditions remain neutral as moving averages are horizontal, MACD is slightly negative, and the RSI is signaling some weakness.

EUR/USD extends 1.1750 rejection

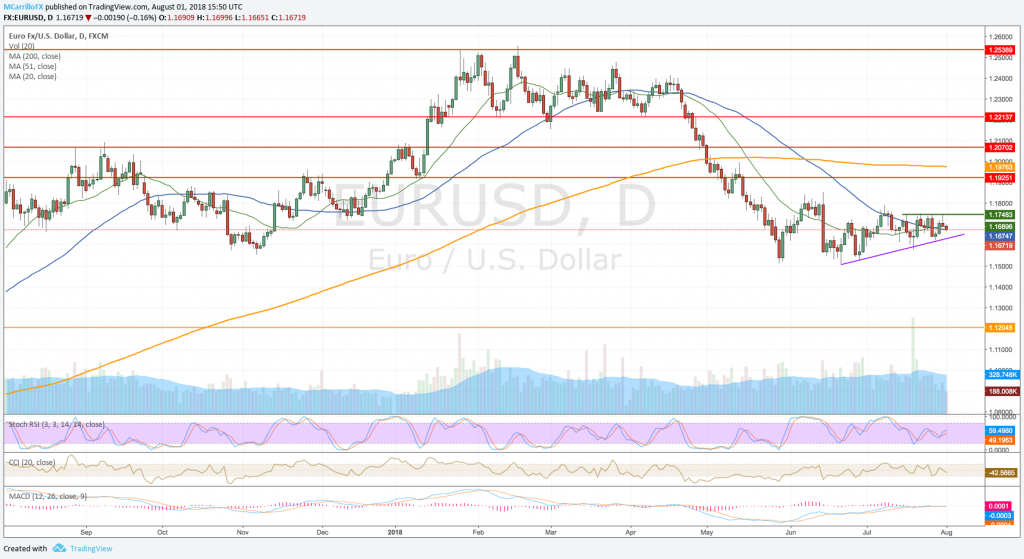

EURUSD daily chart August 1

The Euro was unable to break above the 1.1750 level against the US dollar on Tuesday. Thus, the EUR/USD got a rejection that sent it to trade as low as 1.1660.

The EUR/USD is currently trading at daily lows, and it is posting a 0.25% decline so far on the day.

The EUR/USD seems to be trading inside of an asymmetrical triangle with a confluence of 20 and 50 moving average in the middle. Indicators are in their midlines, just ahead of Federal Reserve reaction and the nonfarm payrolls release.