AUD/USD extends collapses and reaches a fresh 2018 low

The Australian dollar is trading under pressure against the US dollar amid political turmoil and lackluster economic reports down under, and recent USD strength. AUD/USD is trading at fresh 2018 lows.

AUD/USD is trading 1.10% negative on the last day of the week as the pair lost the 0.7200 level and it is trading around 0.7180, the lowest level since December 29, 2016. The cross is under pressure as the USD is trading firm following month end lows and negative NAFTA headlines.

Boris Schlossberg, Analyst at BK traders, said correctly in a recent twitter, “If Trump doesn’t get Canada deal he doesn’t get Mexico deal because he would need 60 votes in Senate and won’t get it.”

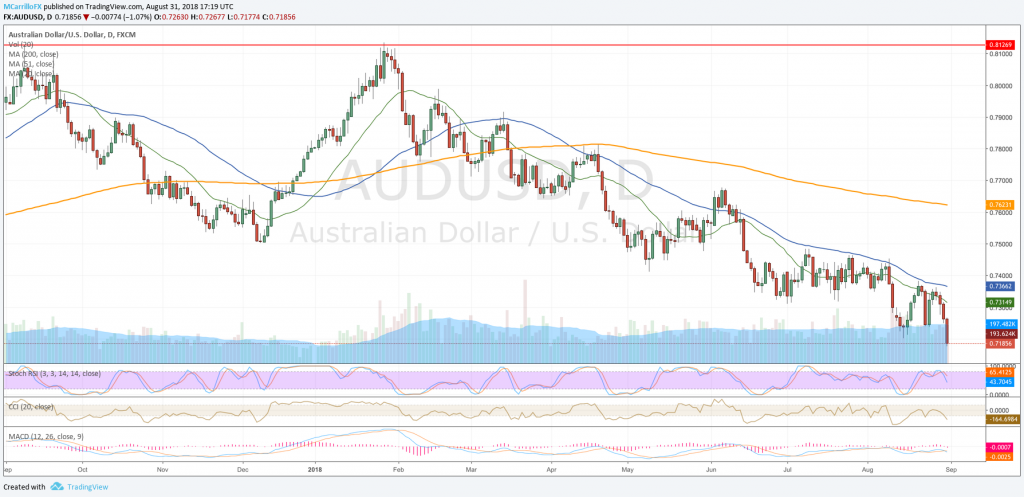

AUDUSD daily chart August 31

The Aussie is trading negative for the fourth day as it has lost 2.5% or 185 pips from August 28 peak of 0.7360 to current levels. Technical conditions remain weak for the pair.

Flavio Tosti, FXStreet analyst, comments that “the bear trend is intact and AUD/USD has still potentially room to the downside to fall. AUD/USD is in a bear channel trading below downward sloping 50, 100 and 200-period simple moving averages. The RSI, Stochastics and MACD indicators are in bearish territories. All suggesting that the risk is skewed to the downside.”

To the downside, if the pair extends its decline and consolidates levels below 0.7200, it will find next support at 0.7160, December 2016 lows, then 0.7150, May 2016 lows, and finally 0.6030 area.

To the upside, the pair needs a close above the 0.7200 area to push bulls on board. Above that, check for the 0.7240 level and the 20-day moving average at 0.7315. Then, 50-day MA at 0.7365.