Bitcoin bounces at 7,795; ready to test the 8,500 fundamental level

Bitcoin rallied from 7,280 on July 21 to get the 8,500 area on July 24 and 25 against the US Dollar. On that level, the pair was rejected and launched back to 7,795, where the cross but a new leg and it got ready for another run.

BTC/USD is currently trading 0.25% negative on Sunday at 8,208.25.

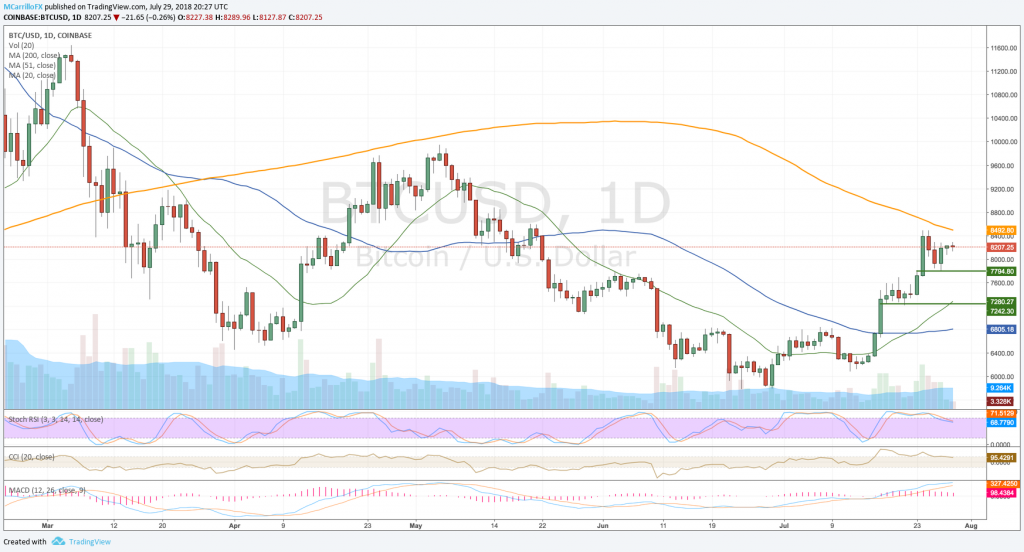

BTCUSD daily chart July 29

The pair is struggling with short-term resistance at 8,290, but it seems ready to launch a new attack on the 8,500 area, July 24 and 25 highs, and the 200-day moving average level.

ForexCrunch analysis Yohay Elam commented in a recent article that “Bitcoin has a major hurdle around $8,210. This is the congestion of the Bolinger Band one-hour Middle (Stidv. 2.2), the Fibonacci 23.6% one-day, the Simple Moving Average 5-one-hour, the Fibonacci 23.6% one-week, the SMA 10-one-hour, the SMA 200-15 minute, the SMA 10-4h, the SMA 50-15m, the SMA 100-15m, and the BB 15-Middle.”

Elam states that this price is a primary battleground. That being said, a break above that level would push the cryptocurrency higher to the 8,500 and even more, if stops losses are triggered.

Technical conditions are starting to show some exhaustion with MACD pointing to the north, but RSI is signaling a slowdown in the rising path. Moving averages are mixed.

Omkar Godbole in a recent CoinDesk article affirmed that “it is worth noting that BTC is still up 40 percent from the June 24 low of $5,755, despite the pullback from the two-month highs above $8,500. Thus, it is safe to say the bull market is intact.”

As a summary, short-term outlook remains bullish with the 200-day moving average at the verge. BTC/USD built a new bullish leg at 7,795.

As for the upside, the pair will find resistance at the mentioned 8,290, and the 200-day moving average at 8,500. Then, the pair will have easy access to the 8,640 and 8,900.

To the downside, the 7,795 is the next support right now; below there, check for the 7,280 area and then the 6,805.