Bitcoin consolidates above 7,000; waiting for a new leg

The crypto market traded Wednesday on consolidation mode and opened Thursday with sideways as market is waiting for a new catalyst to push cryptocurrencies like Bitcoin and Ethereum go for further gains.

The next catalyst for cryptocurrencies may be the European politicians meeting on risk and challenges created by digital assets that will be held on September 7 in Vienna. Politicians will be talking about money laundering, transparency, terrorism financings and regulation to protect investors.

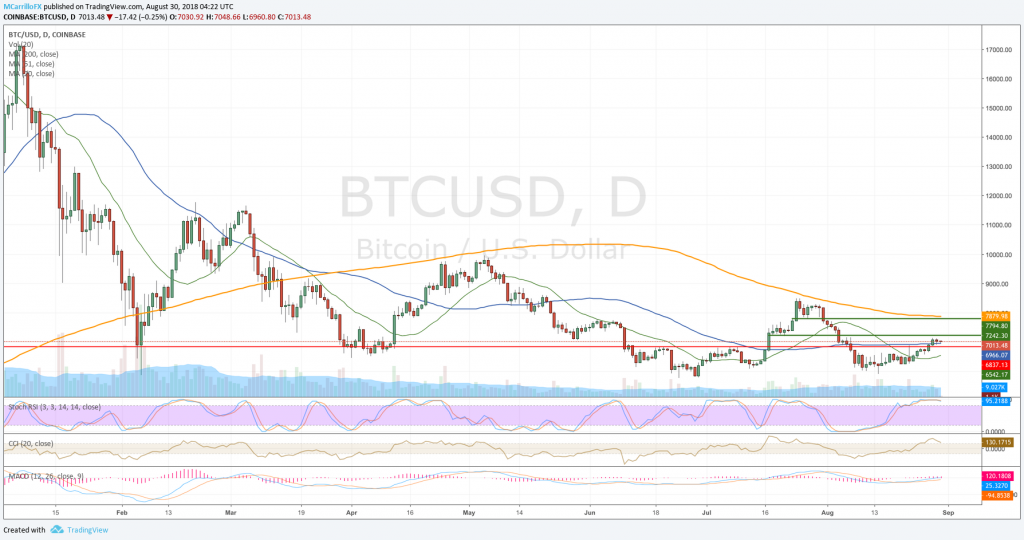

Bitcoin daily chart August 30

Back to the chart and after rallying from 6,250 on August 22 to trade as high as 7,130 on August 28, bitcoin is trading in consolidation mode between 6,920 and 7,120 against the US Dollar. BTC/USD is keeping levels above the 50-day moving average at 6,965.

Technical conditions are now neutral, an improvement from the weak situation of the BTC/USD in the last weeks. MACD is now negative to neutral, while RSI is showing signals of upside potential and moving averages are completing a turnaround for the north.

If the pair remains above the 7,000 area, it will find next supports at 7,130 and 7,240. Above there, 7,795 and the 200-day moving average at 7,880 are the selling zones to consider.

To the downside, If the pair loses the 50-day moving average at 6,965, it will find immediate support at 6,840. Below there, the 20-day moving average level is at 6,540, followed by the 6,250 area and the 6,000 critical line.

Yohay Elam, FXStreet analysts highlights the 7,000 level for BTC/USD. “The powerful Fibonacci 61.8% one-month awaits at around $7,000. Close by, we find $6,968 which is the confluence of the PP one-week R1, BB one-day Upper, the Fibonacci 61.8% one-day, and the SMA 50-oned-ay, the SMA 50 one-hour, and the SMA 200-15m.”