Bitcoin recovery stalled at 7,700; Ethereum down for the third day

Bitcoin and Ethereum are right now the yin and the yang of the cryptocurrency market; while one is consolidating 1-month highs, the other is falling for the third day.

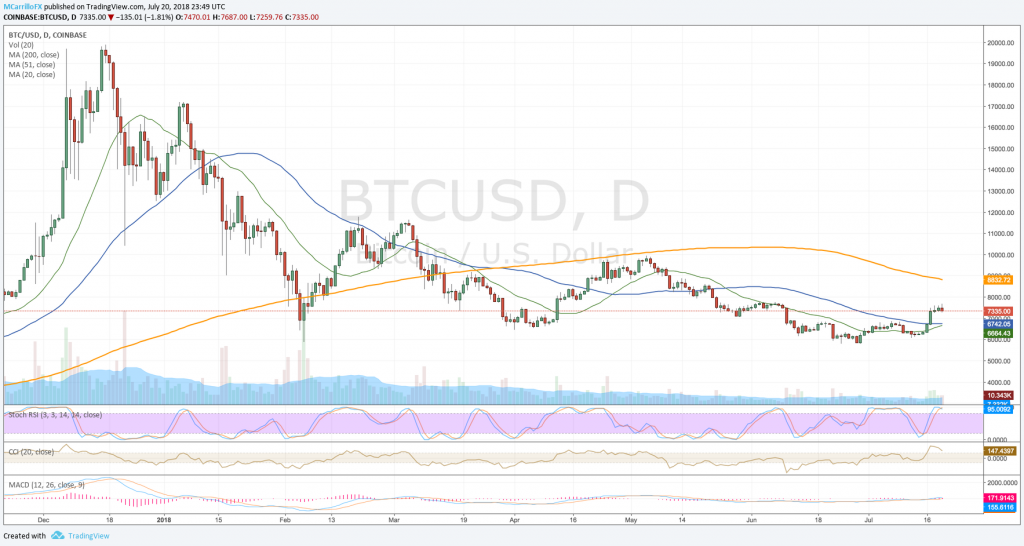

BTCUSD daily chart July 20

Bitcoin is closing the day 1.6% negative at 7,350 after retreating from highs since June 9 at 7,687. The BTC/USD is consolidating levels after the previous 7-day rally from July 14 at 6,187 to today’s highs.

Technical situation for Bitcoin is bullish, but it is showing some signals of exhaustion. Moving averages are mixed, the pair is overbought, and momentum is starting to fade.

To the upside, the pair needs to keep prices above 7,300 to confirm the bias. Above that, next resistances are at 7,665, 8,000, and the 200-day moving average at 8,830.

To the downside, if the pair breaks below the 7,300, it will find next supports at the confluence of the 20 and 50 days moving averages. Then, 6,100 and 5,750 as next buying zones.

Ethereum down for the third day

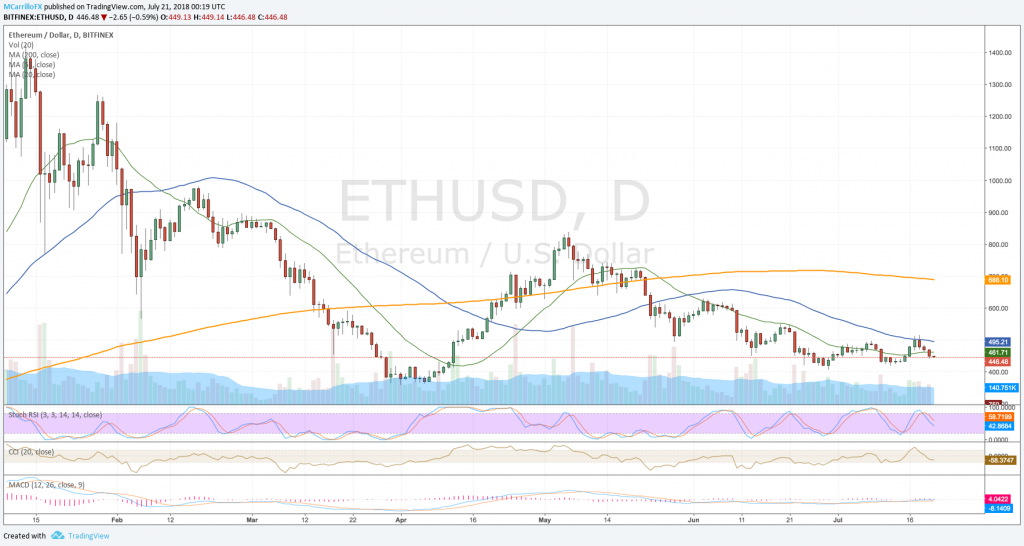

ETHUSD daily chart July 20

Ethereum is trading with a negative note as it is logging its third day with losses. Technical conditions suggest more downside and the 400 level will be crucial.

ETH/USD is currently trading 4.16% negative at 449.15. The pair is extending its rejection from the 515.90 high of July 18 to trade as low as 440.00 earlier today.

Technically, the chart is showing a consolidation pattern following a long-term downtrend. In the short term, the pair is trading in a slightly upside channel pattern now between 418.00 and 510.00. Moving averages are pointing to the downside.

To the downside, the pair needs to consolidate levels below the 20-day moving average at 461.00 to confirm the extension. Then, next supports are at 419.00, 406.00 and 360.00.

To the upside, the pair needs a break above the 20-day moving average and a close above the 50-day moving average at 495.25 to confirm the recovery. Then, resistances are at 544.00 and 620.00.