Boeing jumps to the 350.00 area as its share gets an upgrade

Analysts at UBS considers that Boeing has the best upside potential in its sector and they have upgraded BA share price target as much as 50% to $515 per share.

“We believe Boeing shares carry the best upside in the sector,” UBS analyst Myles Walton affirmed in a recent note. The analyst also notes that trade tariffs are adding concern to the share, but it should be used as buying opportunities.

Walton comments that the growth in the commercial plane segment is giving extra stamina to Boeing. 60% of Boeing’s earnings come from the sale of commercial airplanes, so investors are considering that Boeing has enormous potential if they attack the service contracts.

Previously, UBS considered Being as a neutral stock, but from August 16 onward, it is a BUY share.

UBS is not the only financial institution having Boeing in a good word. The Street Ratings considers Boeing as a BUY with a target price of $415.13 per share.

According to The Street rating, the company offers a solid stock price performance, impressive record of earnings per share growth, revenue growth and compelling growth in net income.

“Powered by its strong earnings growth of 29.96% and other important driving factors, this stock has surged by 46.69% over the past year, outperforming the rise in the S&P 500 Index during the same period. Regarding the stock’s future course, although almost any stock can fall in a broad market decline, BA should continue to move higher despite the fact that it has already enjoyed a very nice gain in the past year.”

Boeing jumps to 350.00 per share

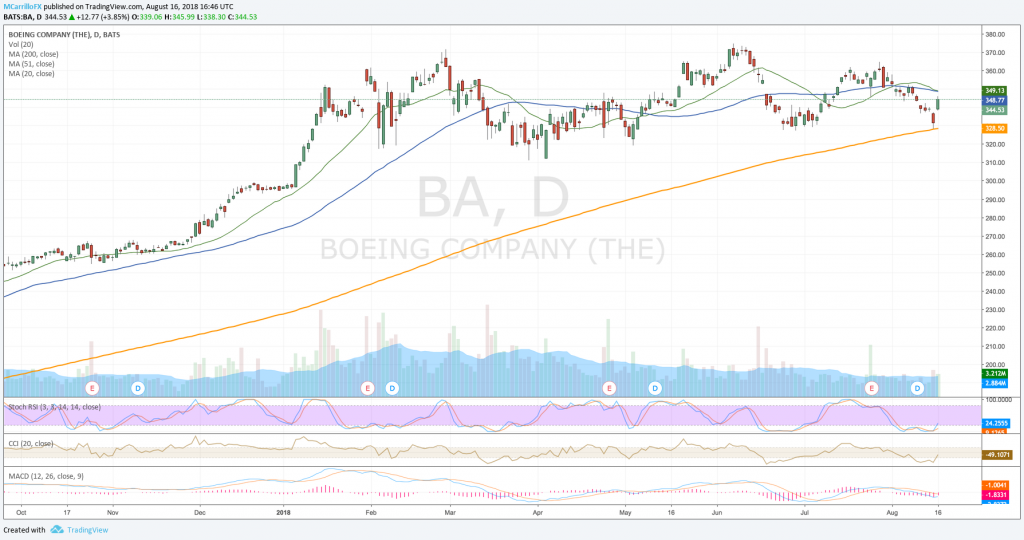

Boeing BA daily chart August 16

Shares of Boeing are trading 3.77% positive on Thursday at 344.32 as investors cheered UBS rating upgrade and new trade talks between China and the United States. The sentiment is clearly positive, and the unit is now facing the 350 area, where the 20 and 50 days moving average is waiting for the share.

BA is extending its bounce from the 200-day moving average at 328.50 performed yesterday. Boeing has underperformed the market when compared to the S&P 500 over the last 50 trading days. MACD is bearish at this time. Momentum, as measured by the 9-day RSI, is negative. Thought both are improving.

To the upside, as mentioned, resistance is at 350.00. Above there, check for the 360.00 area and July 27 high at 364.55. To the downside, 330.00 and the 200-day moving average at 328.50 are the supports.