Cryptocurrencies on the downside; no signals of bullishness

Major cryptocurrencies closed Thursday with declines as investors don’t find clues or a catalyst that can make cryptos great again.

Bitcoin loses the 6,375 level and trades at minimums since 6,075.

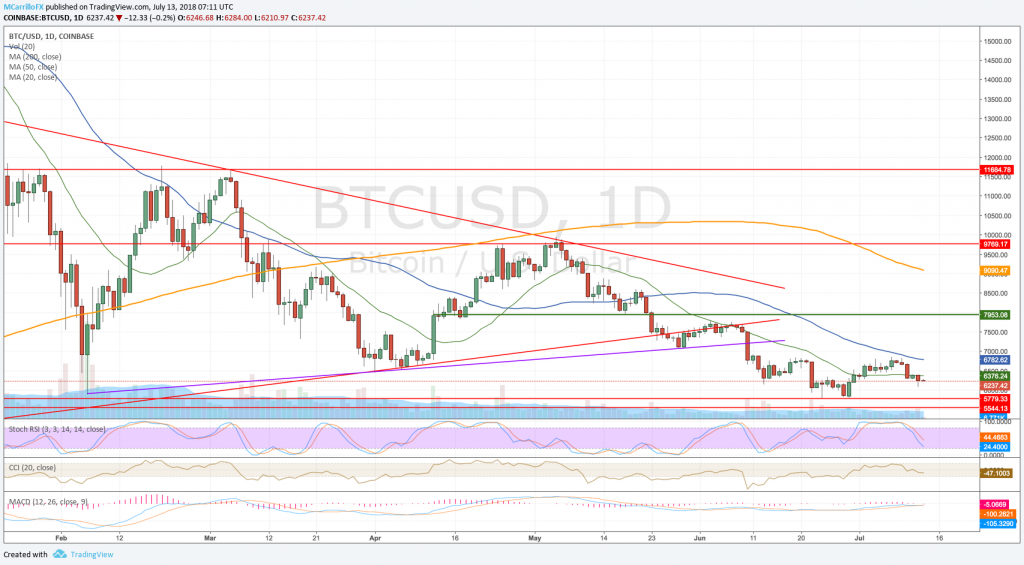

BTCUSD Daily chart july 13

The crypto king closed Thursday with red numbers as the BTC/USD lost the 20-day moving average at 6,375 and it fell to a July minimum of 6,075.

The pair is currently trading at 6,235, 0.24% negative on the day. The pair is in consolidation mode following the rejection of the 6,785 level on July 9.

Technical conditions are bearish with moving averages pointing to the south. RSI and MACD are suggesting more bearishness,

Ethereum made a one more steps on its dovish situation

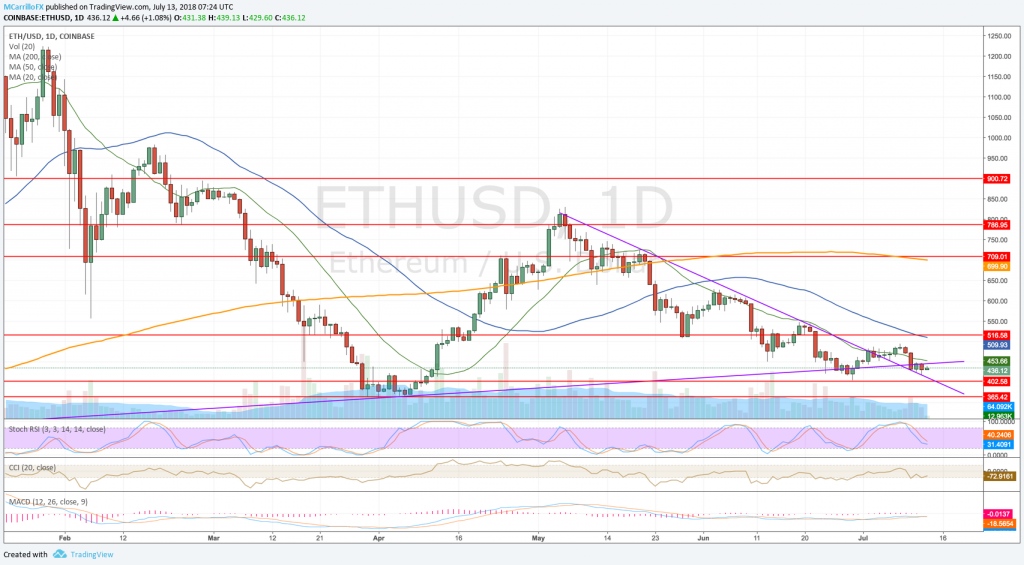

ETHUSD daily chart July 13

Ethereum is on consolidation phase after the pair broke below the dynamic support at 445.70 on July 10. Then, the cross has been trading horizontally over the last three days.

ETH/USD is currently rising 1.03% on Friday at 435.90. Technical conditions suggest more bearishness in the middle term.

Moving averages are pointing to the downside as well as MACD and Momentum are confirming the bearish risk.

To the downside, the ETH/USD needs to keep levels below the 445.00 area before starting a new bearish wave. Next supports are at 420.20, 402.60 and 365.00.

To the upside, the ETH/USD needs a close above the 445.00 level. Then, 495.00 and 515.00 are the next resistance.

Bitcoin Cash crushed at 696.30

Bitcoin cash is under pressure by different situations; one is the 20-day moving average that is crushing the BCH/USD to minimums around 670.00.

Moving averages are aligned to the south; while momentum is giving sellers new hopes. CCI and MACD are on bearish position.

To the downside, Bitcoin Cash needs to break below 663.00 as an initial step for southern prices. Then, 650.00 and 600.00 are the next supports.

To the upside, BCH/USD need a close above the 20-day moving average at 728.00. Then, the 50-day moving average wait for the pair at 870.00.