Dollar’s demand sends the EUR/USD to 1.1300, 14-month lows

Euro’s free-fall against the US Dollar continues on Wednesday with the EUR/USD extending declines to test lows since June 2017 at the 1.1300 area. Unstoppable dollar and upbeat US economic data spur the greenback even more.

As reported earlier, retail sales in the United States rose 0.5% in July, above the 0.1% increase expected by market and more than the 0.2% increase in June. Retail sales ex-autos jumped 0.6% in July, the double of the 0.3% expected and an acceleration from the 0.2% in June.

New York Empire State Manufacturing index jumped to 25.6 in August from 22.6 in July. Expectations were for a drop to 20.0.

On the other hand, industrial production in the United States rose just 0.1% in July, below the 0.3% expected by the market and a slowdown from the 1.0% posted on June.

In this framework, the EUR/USD extended its decline for the second day and after consolidating levels below the 1.1400, the pair quickly dropped to test the 1.1300 area.

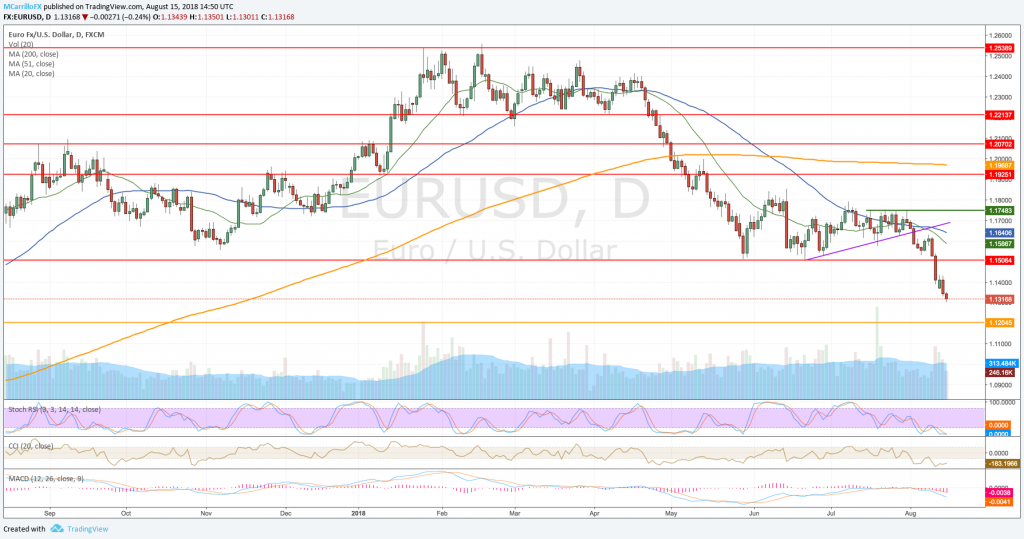

EURUSD daily chart August 15

The EUR/USD is currently trading 0.20% negative on the day at 1.1320. Risk aversion amid Turkish crisis and dollar demand on interest rate differentials and speculations for a new hike on September defeated the euro against king dollar.

As a matter of context, the dollar index accelerated to test the 97.00 area on Wednesday. On the day, DXY is trading 0.27% positive on the day at current levels at 96.90. The greenback is logging its fifth positive day in a row. Experts consider any dollar pullback as a buying opportunity.

Technical conditions suggest more room for declines as MACD is below its midlines and the RSI is showing a healthy downtrend. Moving averages are accelerating to the south.

To the downside, If the pair breaks below the 1.1300 area, next supports would be found at 1.1280, 1.1200 and 1.1115. Below there lies the critical 1.1000.