EUR/USD finds support at 1.1365 and closes up above 1.1400

The Sell-off in the Euro got a pause on Monday as investors bought euros and sold dollars amid profit taking and hopes of resolution of the Turkish crisis.

EUR/USD traded positive on Monday as the pair recovered the 1.1400 area after losing over 200 pips on Thursday, Friday, and early Monday sessions. However, the cross is now trading slightly negative on Tuesday.

The crisis in Turkey is pressuring the single currency amid fears of contagion into banks in the union. However, after EUR/USD sell-off last week, investors are looking for buying zones on hopes of a Turkish solution.

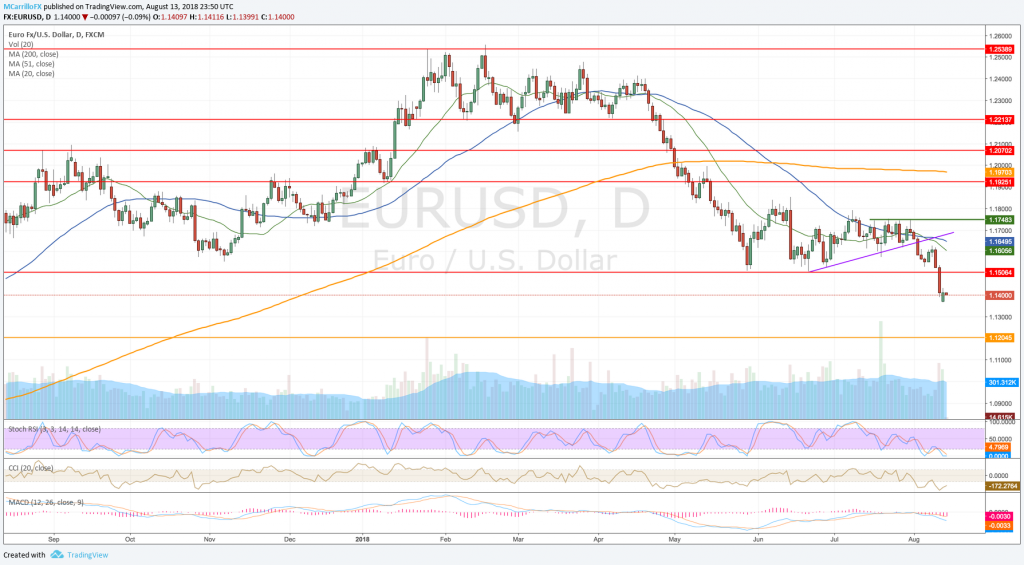

EURUSD daily chart August 14

Technical conditions for the EUR/USD are weak with MACD below its midlines, and RSI suggesting that the downtrend is strong. However, the main factor for a recovery in the pair is the resolution, or something similar, in the Turkish case.

ForexLive analysis Greg Michalowski pointed out in a recent article that “the pair traded to a low of 1.13645 which was the lowest level since July 2017. That low got within eight pips of the 200 week MA at 1.1356. Last week, the price fell below the 100 week MA at 1.1460.”

Michalowski concluded that “those two MAs will be eyed by traders for the next bias clues. Move below the 200 weeks MA keeps the sellers in firm control. Holding that level will still have to contend with the 200 weeks MA.”

To the upside, if the pair consolidates levels above 1.1400, it will find next resistance at 1.1505, then, check for the 1.1615 and the 1.1650.

To the downside, first support comes at Monday’s low at 1.1365, below there, next buying areas come at 1.1340, 1.1280 and 1.1200.