EUR/USD rejected at 10-day highs; back to losses

The Euro opened the forex week with a strong note as the pair reached highs since July 11 at 1.1750 against the US Dollar. However, the EUR/USD turned negative in the European session, and it closed the day with losses.

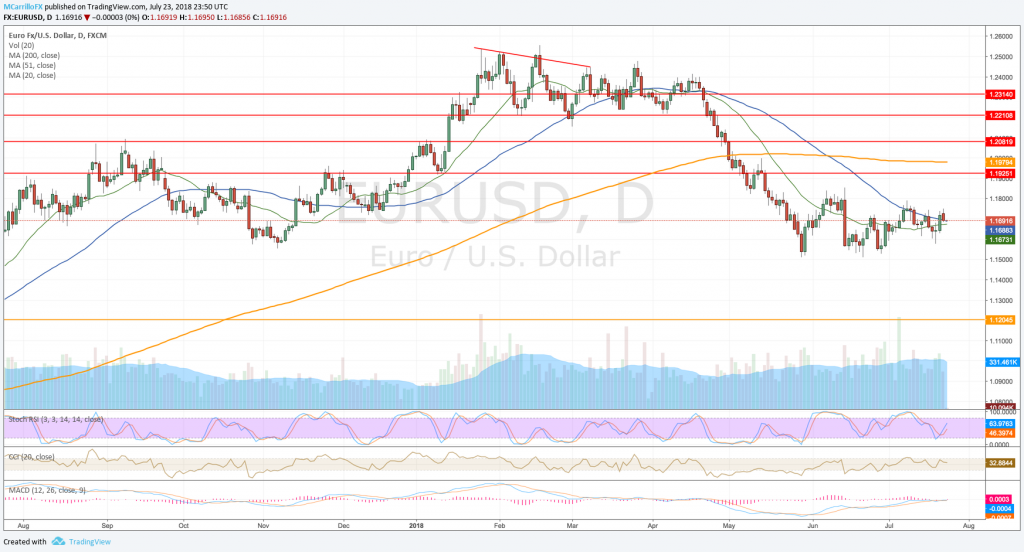

EURUSD daily chatrt July 23 b

On the other hand, the Dollar index managed to recover some ground after falling to test the 50-day moving average. The DXY bounced at this level, and it traded back to green numbers. The DXY closed the day around 94.70.

The greenback is getting the favor of the 50-day moving average that has been supporting the index since its break at April 19.

In a consolidation mode throughout a quiet day, The EUR/USD closed 0.20% down on Monday as the pair finished the day at 1.1690, well below the highs around 1,1750. Currently, the cross is trading at 1.1690 as it is fighting to break the 50-day moving average at 1.1690.

The EUR/USD stopped on Monday a two day’s bounce from 1.1580 on Thursday, July 19, when the 1.1750 area rejected the pair. Technical conditions are neutral as the MACD is neutral, but RSI is pointing for a strengthening. Moving averages are mixed.

To the downside, the pair needs to break below the 20 and 50 days moving averages confluence around 1.1670-1.1695. Below that, the cross will find next supports at 1.1580, 1.1550 and 1.1515.

To the upside, the pair needs to keep levels above the 50-day moving average line around 1.1695. Above that, 1.1750 is the next frontier, then 1.1800 and 1.1850 are the last frontiers.

On the fundamental field, check market PMI composite and service indexes in France, Germany, the Eurozone and the United States. Also, the housing price index and Richmond Fed manufacturing index that all can affect the EUR/USD fluctuations.