EUR/USD up on the day as investors digest lowest US consumer sentiment since Sept

The euro is extending its bounce from 1.1300 against the US Dollar on August 15 to trade above 1.1400 on Friday following a weaker the expected Michigan Consumer Sentiment Index in August.

The Michigan Consumer Sentiment Index declined from 97.9 in June to a 95.3 figure in July, a number against the increase to 98.0 expected by market. It is the lowest number since the last September.

Current economic conditions declined to 107.8 in August from 114.4 in July. Index of consumer expectations remained unchanged at 87.3 in July.

According to the University of Michigan official release, 1-year inflation expectations remain at 2.9%; while the 5-10 year inflation expectations rise to 2.5% versus the 2.4% expected previously.

Most of the decline in the index reflects less favorable assessments of housing buying conditions. Richard Curtin, Surveys of Consumer chief economist, said in the official release that “consumer sentiment slipped to its lowest level since last September, with the decline concentrated among households in the bottom third of the income distribution. The dominating weakness reflected much less favorable assessments of buying conditions, mainly due to less favorable perceptions of market prices.”

EUR/USD positive for the third day

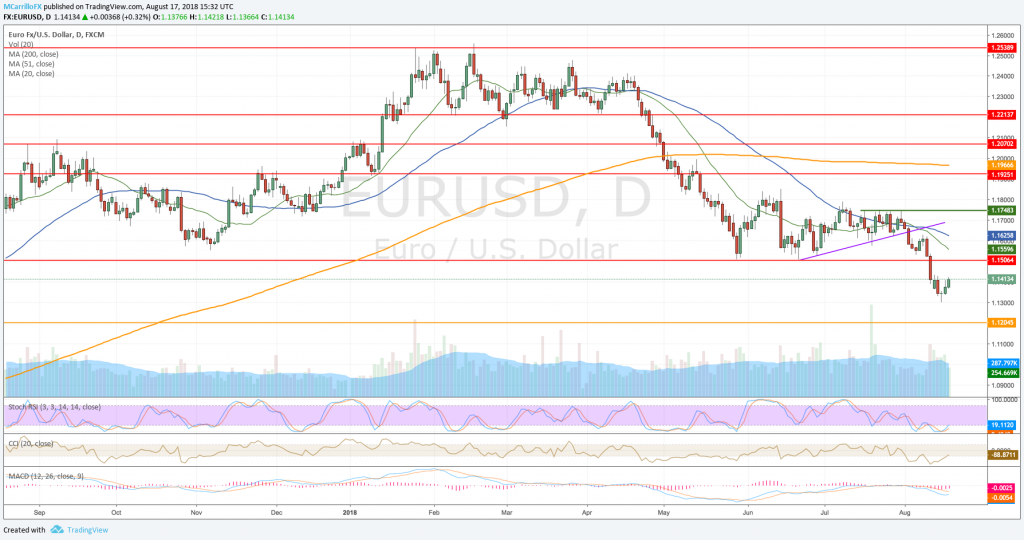

EURUSD daily chart August 17

The EUR/USD is trading positive for the third day as the pair is posting 0.32% gains so far this Friday at 1.1412. The cross is fighting for a close above the 1.1400 level after bouncing back at 1.1300 on August 15.

Talking about technical conditions, Adam Button, analyst at ForexLive, says that “it’s a nice bounce from the worst levels of the week, but if you look at the big picture, the euro is in a terrible spot. A close today above 1.1433 would be a nice start to a turnaround, but the pair needs to get above 1.1500 to put any real questions in the minds of the sellers.”

The next resistance is, as mentioned above, the 1.1500 area, with the 20-day moving average at 1.1560 and the 50-day moving average at 1.1625. However, the real frontier for the EUR/USD is at 1.1750, where everything can happen.