Forex Fundamental: EUR/USD turns positive on ECB rate hike speculations

The Euro is currently trading with a slightly positive note that turned the EUR/USD positive on the day following a news that said some ECB officials see end-2019 rate hike as “too late.”

According to Bloomberg, which is citing sources familiar to the matter, a move in September or October 2019 “is on the cards.” It is a contrary message from the latest ECB meetings as they only discussed its plans to end net asset purchases this year, but nothing about hikes earlier than the last quarter of 2019.

Market expectations for a European Central Bank rate hike in September increased to an 80% of chances from 69% previous the report.

Euro up to range’s top

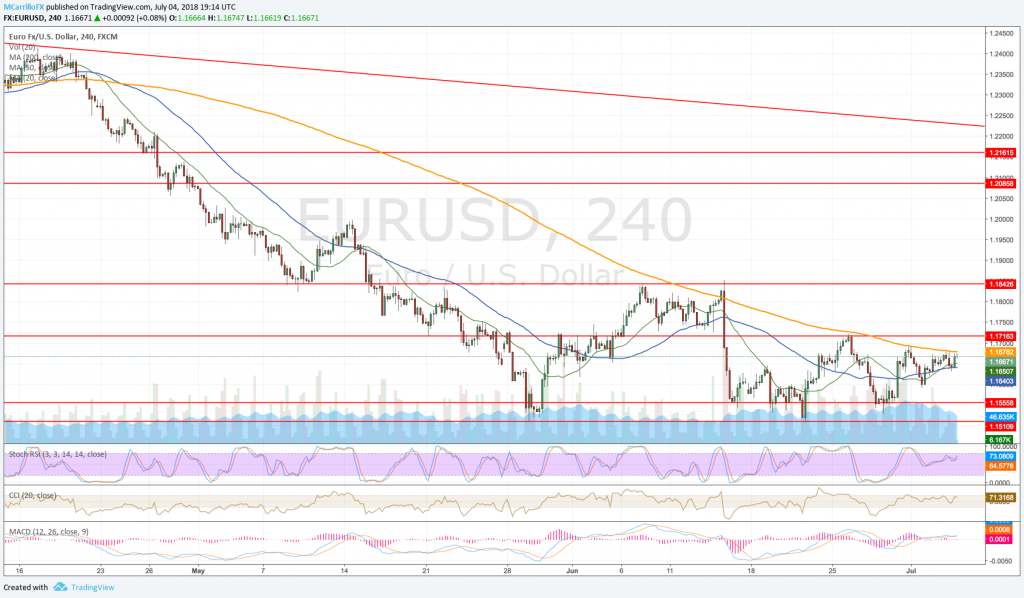

EURUSD 4-hour chart July 4

In this framework, the Euro got a boost that erased its early losses against the US dollar, and it put the EUR/USD in the green field.

The EUR/USD is currently trading 0.10% positive on the day at 1.1670. The pair is trading in consolidation mode following its June 28 bounce from 1.1530 to 1.1690. The Cross remains subdued by the 20-day moving average at 1.1665.

Previously in the day, the EUR/USD opened Wednesday with an advance to 1.1680, but the pair got a rejection that sent it to 1.1630, where it moved horizontally until the ECB report.

The news marked a game change as the pair was immune to good news like it happened earlier on Wednesday after two upbeat PMI readings in Germany and the Eurozone.

It seems to be no longer possible following the small, but significant, movement after the ECB hike rate speculations and facing the second half of the week that will include the ADP report and the nonfarm payrolls release.

In the short term, the EUR/USD bullishness is contained by the 200-period moving average in the 4-hour chart, currently at 1.1680. A close above that level is needed before consolidating an uptrend.

Above 1.1680, next resistance would be found at 1.1690 and the crucial 1.1715.

To the downside, if the pair gets a new rejection fro the 1.1680, it will find support at 1.1635 and then the 1.1600 area. Below that, 1.1550 and 1.1510.