GBP/USD capped at 1.2900 as dollar reacts

The British Pound was unable to consolidate gains above the 1.2900 level against the US Dollar as the greenback reacted positive following US consumer confidence and it stopped losses.

In the United States, the CB consumer confidence jumped to its highest level in eighteen years at 133.4 in August from the 127.9 figure posted on July. The previsions were crushed as market expected a decline to 126.6.

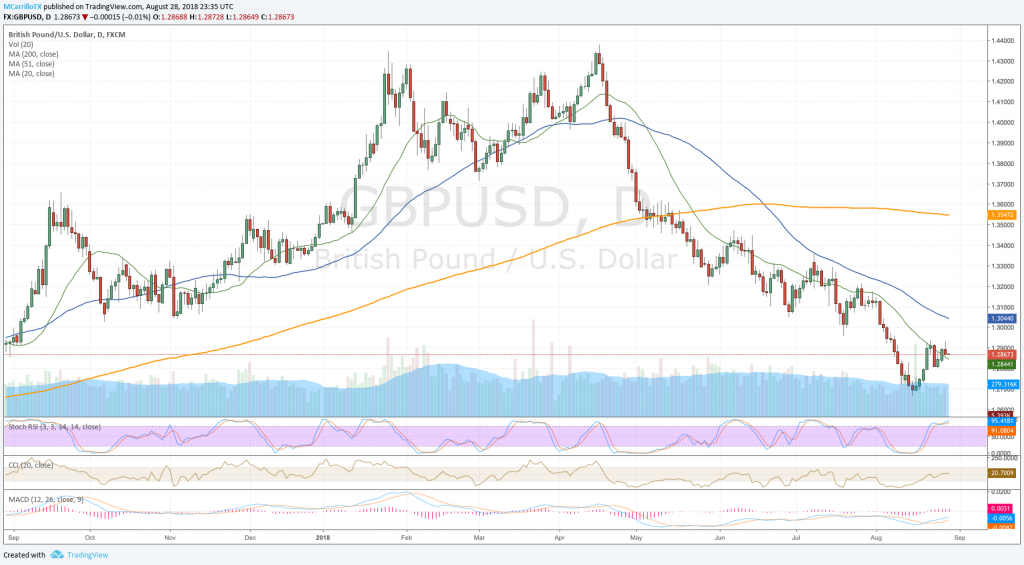

The GBP/USD was trading in recovery mode following a bounce at the 1.2800 area on August 23 as the pair extended gains for two trading days until being rejected at the 1.2930 on Tuesday. Cable closed the day on red and trading below the 1.2900 again.

GBPUSD daily chart August 28

The Sterling is opening Wednesday almost flat as the bears are fighting back to maintain control. The pair failed to hold gains and dropped below the 1.2900, opening the doors for more declines. However, the 1.2850 is acting as support according to analysts at Scotiabank.

“The market is struggling to make new short-term cycle highs,” said the bank in a recent note. Analysts believe that the trend is neutral and even negative beyond the 1-hour studies. “Above 1.2960 will give the GBP a little more room to improve. Support is 1.2850.”

FXStreet analyst Matias Salord affirmed in a recent article that the pound remains weak in a market that is concern about a no deal Brexit. “The UK government is presenting plans for what could happen if a deal is not reached before March. PM May said today it “would not be the end of the world”. Without clarification, Brexit will continue to be a relevant source of uncertainty and also of volatility.”

Back to the chart, if the GBP/USD clears up the 1.2930, it will find the next resistances at 1.3000 and 1.3045. To the downside, check for the 1.2800, and the 1.2670.