GBP/USD extends collapse amid Brexit no-deal talks; near to 1-year low

The British Pound is trading down for the fifth day in a row as investors are selling the Sterling amid fears of a no-deal for the Brexit. Speculations are pulling up for the possibility that the UK government and EU commission will not reach an agreement. Time is running out.

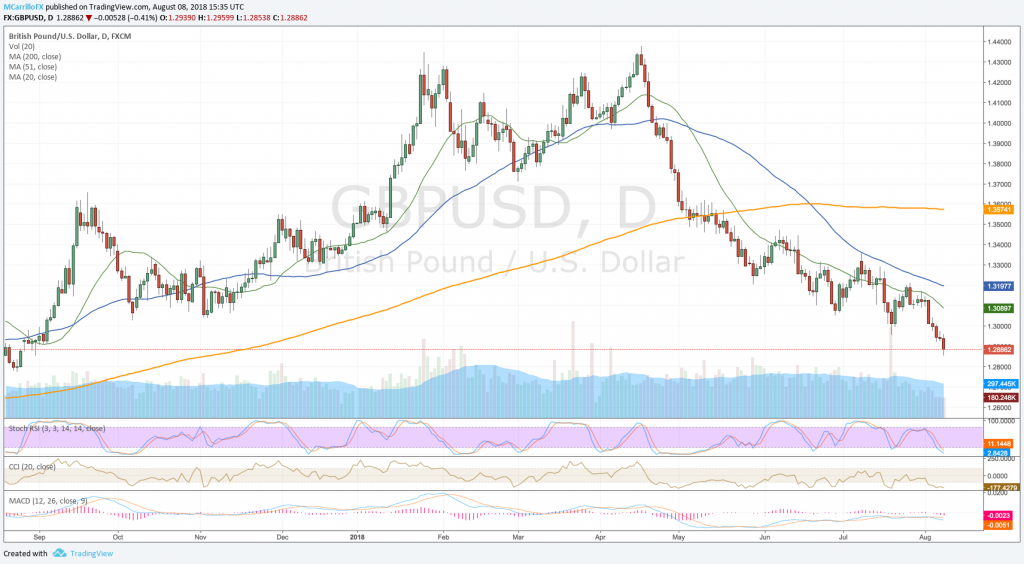

GBP:USD daily chart August 8

GBP/USD is trading 0.44% down on the day at 1.12880 following the United Kingdom announcement they are planning a no-deal Brexit meeting in September. The news points out fears for a no-deal scenario. The cable is trading 2% down in August.

As a no-deal Brexit scenario is becoming the official strategy, the GBP/USD is trading at its lowest level since August 31 last year. Cable is exposed now to further selling pressure with the 1.2780 as the most likely level to be reached in the drop.

ING Economic and Financial analysis James Smith affirmed in a recent article that the “talk of a ‘no deal’ Brexit is ramping up as UK lawmakers remain divided on future European trade.”

ING still thinks “it’s more likely that an agreement will be struck to prevent the UK from crashing out of Europe without a deal.”

On the fundamental sphere, the United Kingdom will release its Gross Domestic Product report for the second quarter of 2018; expectations are for 0.1% quarterly increase and a 1.2% year over year rise. A weaker than expected or even an in-line-of-expectations figure would spur more sales for the Sterling. 1.2780 is the next critical level on the downside as previously mentioned.

Technical conditions for the GBP/USD are deteriorating with the pair below significant levels and moving averages pointing to the south. MACD is signaling further declines, while the RSI shows a healthy downtrend.

To the downside, immediate support is at 1.2780, the 12-month low. Below there, check for the 1.2600 and the 1.2560 areas as buying zones.

There are no reasons to believe in the upside, at least in the technical chart. The only catalyst that can inject life into the GBP/USD is the GDP that will be published on Friday.

Meanwhile, the pair needs a close above the 1.3000 level to start believing in the upside. Above there, the 20-day moving average is at 1.3090, and the 50-day moving average is at 1.3200.