GBP/USD tests 1.2700 as Brexit fears overshadow upbeat unemployment rate

The British Pound traded negative on Tuesday against the US Dollar as the GBP/USD failed to sustain early gains above the 1.2800 area. The pair was dragged by Dollar strength and fears on the no-deal Brexit.

The unemployment rate in the United Kingdom fell to 4.0% in July, below the 4.2% expected by the market, the same in June, and the lowest level in 43 years,

GBP/USD got a rejection on the 1.2800 area, and it was launched 100 pips down to the 1.2700 area where the pair traded at its lowest level since June 27.

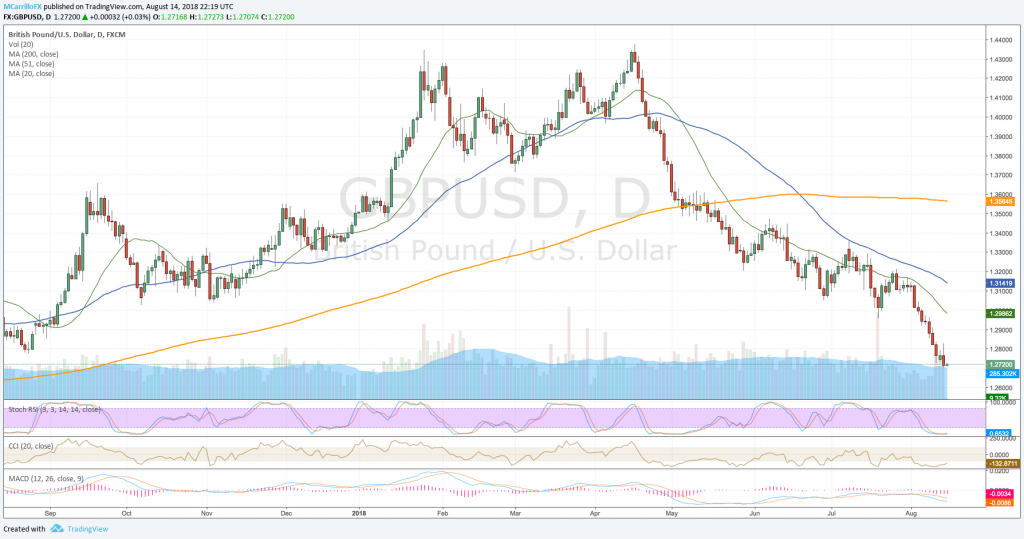

GBPUSD daily chart August 14 Late

Despite an upbeat unemployment rate in the United Kingdom, the GBP/USD was unable to consolidate gains at 1.2800 as investors are concern about the possibilities of a no-deal Brexit. Also, the Dollar index is showing strength in any pip.

The Dollar index rose 0.27% on Tuesday to trade as high at 96.80, its highest level since June 2017. The pair is extending gains after the significant break above the 95.50 and the subsequent 96.50. Now, the greenback closed at 96.65, a price that suggests further increases.

The deal here is the differential between interest rates. While in the United States, the Federal Reserve has an interest rate of 2.0%, and it is expected to be raised to 2.25% in September, in the United Kingdom, the Bank of England has an interest rate of 0.75%. That means that the dollar pays more interests than the GBP. Each dollar will earn more money than each British Pound.

In this framework, any speculation on an interest rate hike will always push a currency up. This time, the dollar up.

Back to GBP/USD, with the pair consolidating levels at 1.2720, more declines are expected. Technical conditions suggest more bearishness with the MACD below its midlines, and the RSI showing weakness for the Cable.

Below the 1.27, next supports would be at 1.2660 and 1.2600. To the upside, check for 1.2800, 1.2900 and 1.2980 as following selling zones.