Technical BTC/USD: the 7,000 level is too much for Bitcoin

It seems that the 7,000 area is too high for Bitcoin, as the king of cryptocurrencies has been unable to break, or even to trade close to the 7,000 area since it was broken to the downside on June 10.

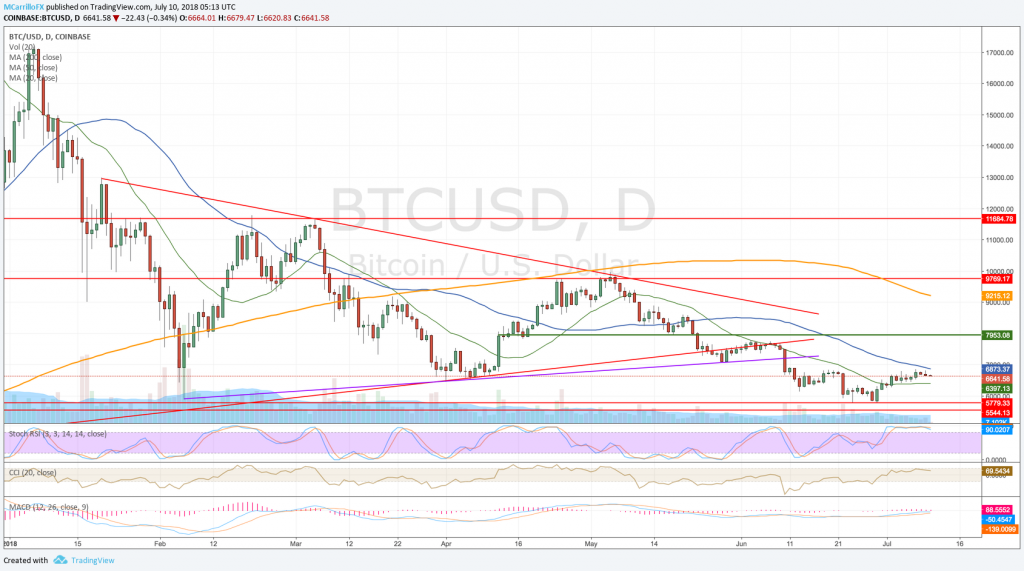

BTCUSD Daily chart July 10

BTC/USD is currently trading at 6,645, 0.29% negative on Tuesday. Bitcoin is logging its third negative day in a row. Previously, the pair trade as high as 6,845 throughout the weekend, in an attempt for a recovery from the 6,440 area.

On the fundamental factor, a cryptocurrency malware created by Chinese hackers infected more than 1 million computers and stoled more than $2 million into years according to a Chineses media. Police arrested 20 suspects while they were working in at a tech firm. Illicit cryptocurrency mining was the charge.

Technically, the unit should go up, but the conditions don’t reflect the price action. Why? People are concerned about cryptocurrencies future. The crypto mojo is gone for now. It can be an opportunity to buy cheap, but it is a risk trade.

To the downside, if BTC/USD falls below the 6,450 level, it will find support at the 20-day moving average at 6,397. Below that, the unit will test the 6,250, 6,000 and the 5,794 significant level.

To the upside, the 7,000 area is the new 7,800 level that was tested a month ago, and the 10,000 price in April. In any case, BTC/USD needs a close above the

Ethereum trades negatively as the pair extends rejection from the 500 area

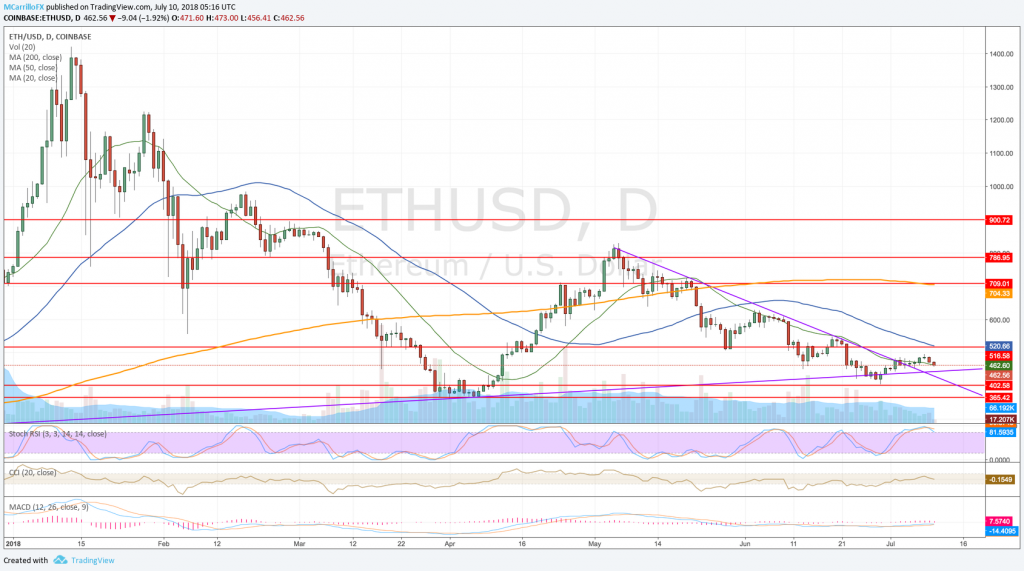

ETHUSD daily Chart July 10

ETH/USD is trading down for the second day in a row as the pair got a rejection from the 500.00 area over the weekend. The unit is trading 1.90% negative at 462.15.

Technical indicators suggest a bearish potential. Moving averages are aligned to the downside, the pair is overbought, but signaling exhaustion and momentum is turning to the negative south.

In any case, the last bouncing leg performed for the unit was supported at 404.20 on June 29. If the pair returns to this level, and the cross breaks it, it will find the ultimate support at 360.00.