The Fed maintains rates at 2% but a hike possible in September; USD up

The Federal Reserve announced its decision to keep its interest rate unchanged at 2%. The decision was in line with expectations. The fed, however, hinted a hike in the September meeting.

In Forex, the decision fueled Dollar appetite as the pair is extending gains for the second day in a row.

The Federal Reserve made minimal positive changed to the language and experts are assuming that Fed’s chairman Powell will announce a new hike in the FOMC meeting in September.

The Fed considers now that the US has a “strong” economy (previously “solid”). The 1-year inflation “remains near” 2% versus “moved close to” 2% in the previous statement.

“The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term.” the official statement said.

After bouncing at 94.15 on Tuesday, the DXY is trading now 0.12% positive at 94.70. As the pair was mainly priced in, movements weren’t violent. Also, the market is in wait-and-see mode ahead of the Nonfarm payrolls data that will be published Friday.

EUR/USD extends 1.1750 rejection ahead of NFP

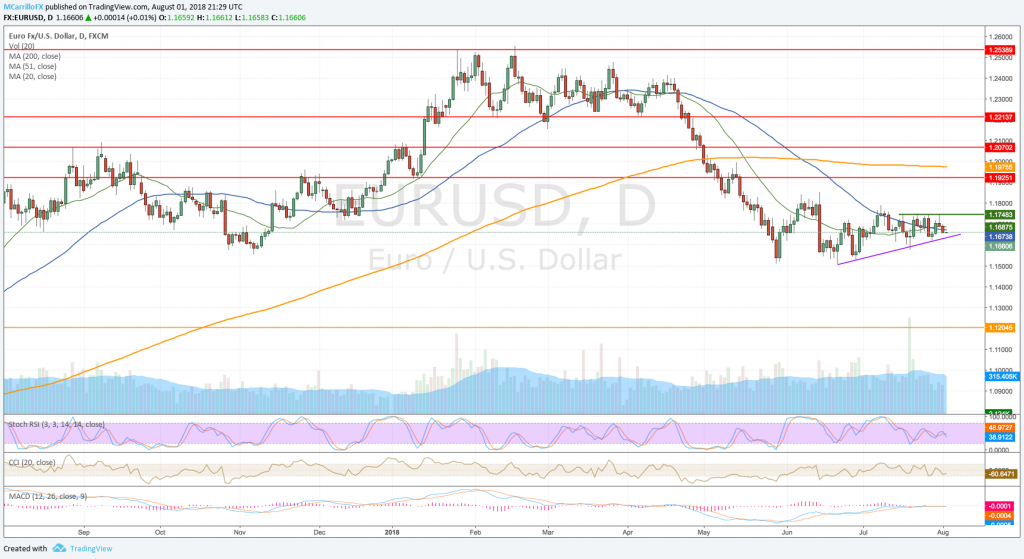

EURUSD daily chart August 1st

The Euro traded down on Wednesday as investors were focused on the Federal Reserve rate decision and a wave of weaker than expected PMI indexes around the world.

The EUR/USD is currently trading at Wednesday’s lows, posting a 0.25% decline so far on the day. The scoop if for the cross is a test of the dynamic uptrend support at now at 1.1635.

The EUR/USD seems to be trading inside of an asymmetrical triangle with a confluence of 20 and 50 moving average in the middle. Indicators are in their midlines, just ahead of Federal Reserve reaction and the nonfarm payrolls release.