Why is the dollar so strong? Inflation and interest rates are the keys

Investing market is currently pricing in an interest rate hike from 2.0% to 2.25% in the United States in the next Federal Open Market Committee. The latest Consumer price index has spurred expectations with almost all experts are waiting for a rate hike.

Consumer price index in the United States rose 0.2% between June and July, in line with expectations. Year over year, inflation was 2.9% in July, the same of June, but below the 3.0% expected by the market.

Inflation excluding food and energy rose 0.2% monthly in July, in line with expectations. On the year, inflation accelerates to 2.4% in July, above 2.3% expected and posted in June.

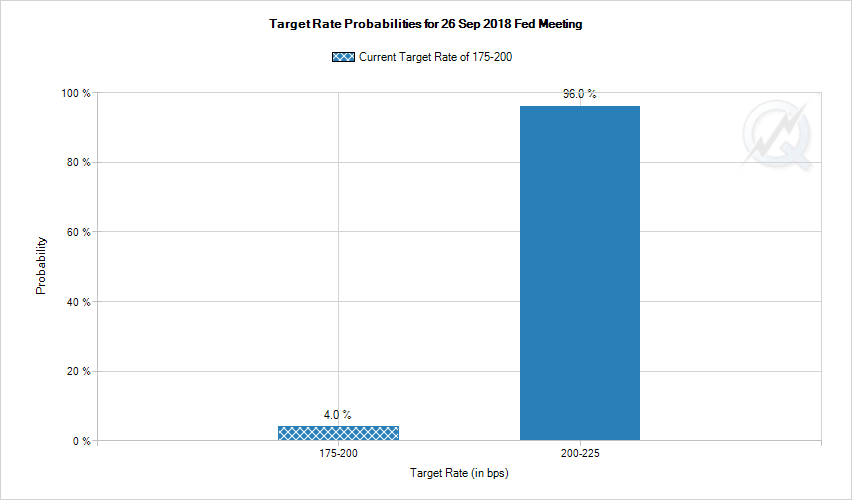

The dollar is the biggest beneficiary of this situation as the interest rate differential would be potentially bigger in September. According to the Fedwatch tool of the CME group, there are 96% of probabilities that the Federal Reserve would increase its interest rate from 2.0% to 2.25% in the September 26 FOMC meeting.

Fedwatch Rate Hike probabilities for August 12

Also, market is mixed regarding the possibility of another hike in December with a 65% of probabilities for a rate hike to 2.5% on December 19.

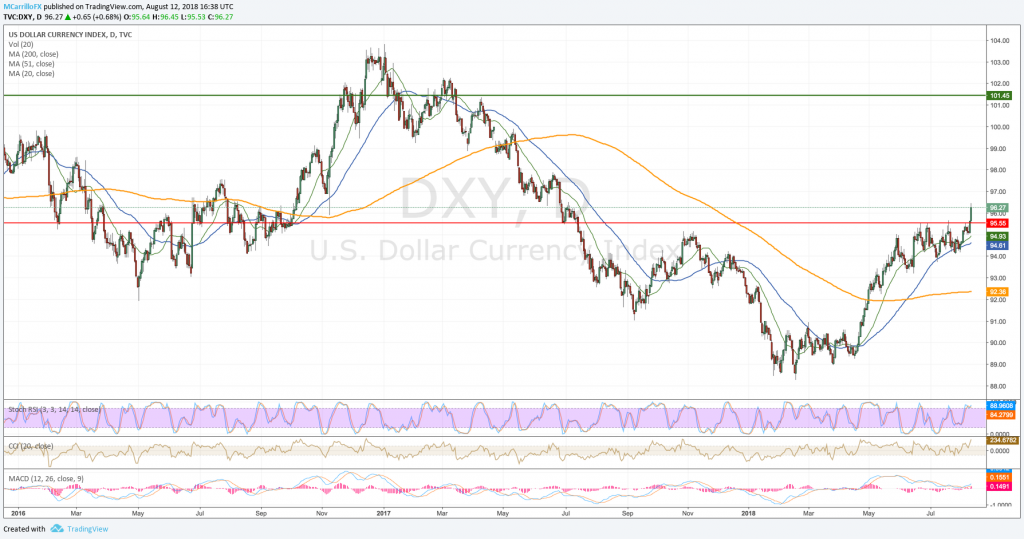

Dollar index at 13-month highs

DXY Dollar index 1-year daily chart august 12

So, Dollar is advancing against its major rivals and the Dollar index is trading at its highest level since July 2017.

The Greenback is currently testing the 96.50 area as a first step to return to the 100.00 level. The pair seems ready to launch a new attack for that milestone as technical conditions are bullish for the USD.

MACD is above its midlines, while RSI is showing that the current uptrend is healthy. Moving averages are aligned and they are pointing to the north.

If the pair extends gains above 96.50, it will find supports at 97.80, 98.70 and the 100.00 critical level. To the downside, the unit needs a close below the 95.50 to give hopes to bears. Below there, check for 95.00, 94.60 and 94.00 as the next buying zones.

Any dollar pullback could be seen as a buying opportunity.