Crude Oil Futures Contract on the CME

The CME (Chicago Mercantile Exchange) Crude Oil futures contract, reflects the price of West Texas Intermediate crude oil. Crude oil can be delivered from anywhere in the word to the settlement destination which is Cushing Oklahoma in the United States. West Texas Intermediate which is also referred to as Texas light sweet, is a grade of crude oil used to benchmark the CME futures contract. This grade, has two specifications. The first, known as the gravity given to the oil by the American Petroleum Institute describes its low density and the second term, which is sweet reflects WTI low sulfur content. WTI is attractive because it can be easily refined into gasoline.

Overview

The CME Crude Oil Futures contract is traded on the Chicago Mercantile Exchange and is considered a global benchmark for crude oil. The contract is delivered in Cushing Oklahoma, and is physically settled which means that if you are long into the settlement period you are required to take delivery of WTI crude oil at a specified location. West Texas Intermediate has as specific gravity and sulfur content that is measured by the buyer prior to taking delivery. CME crude oil futures are priced in dollars per barrel, and there are 1,000 barrels of oil per contract.

Contracts are listed monthly, from January to December, for 6-years and then listed for June and December for an additional 3-years for a total contract series of 9-years. CME Crude oil trades Sunday – Friday 6:00 p.m. – 5:00 p.m. (5:00 p.m. – 4:00 p.m. Chicago Time/CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT) according to the Chicago Mercantile Exchange Trading in the prompt delivery month shall cease on the third business day prior to the twenty-fifth calendar day of the month preceding the delivery month, according to the Chicago Mercantile Exchange.

How to Trade

The CME Crude Oil futures contract experiences prices changes that are driven by many factors, including global oil supply and demand as well as changes to the U.S. dollar. Oil traders follow the weekly inventory statistics that are released by the U.S. Department of Energy in the United States. On a weekly basis, on Wednesday at 10:30 AM ET. The sub-department known as the Energy Information Administration reports its estimate of weekly crude inventories along with information about imports, exports and crude oil runs by refiners.

The weekly numbers are then revised to form monthly estimates that are used to determine U.S. domestic supply and demand. The demand for crude oil generally comes from refiners who use crude oil to create products such as gasoline, heating oil, diesel fuel, jet fuel and a host of other light end fuels such as propane and butane, some of which can be traded as their own commodities.

On a weekly basis, on the Tuesday prior to the Department of Energy’s release of their inventory data, the American Petroleum Institute, which is a private organization, releases its estimate of crude oil and product inventories as well as demand. These numbers are also used by traders to determine the future price of CME crude oil futures. Crude oil can be traded with most commodity brokers.

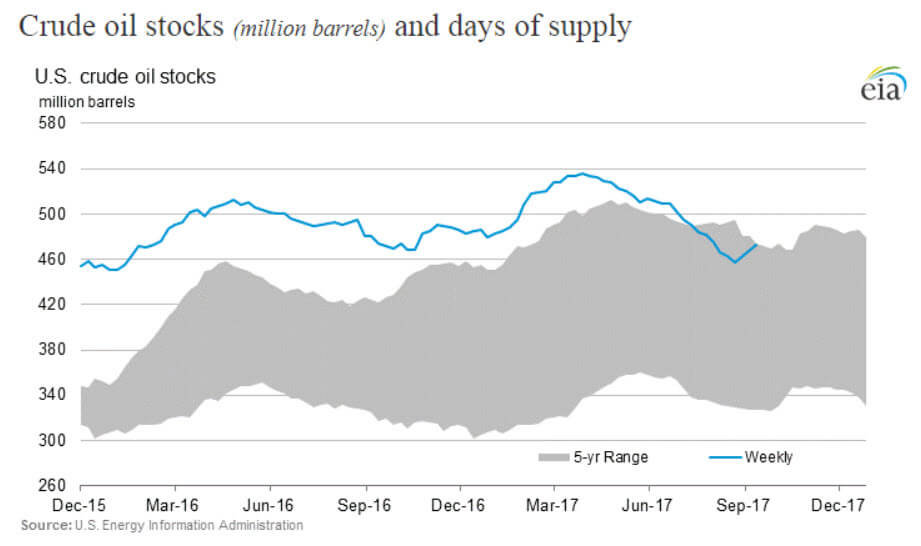

The Energy Information Administration supplies analysis of crude oil inventories and plots this data in several ways including a 5-year average range of crude oil relative to the current level of crude oil stocks for the present time of year.

The largest supplier of crude oil is OPEC, the Organization of Petroleum Exporting Counties. This cartel of oil producers, also provides information on current global supply and demand. Additionally, OPEC consistently tries to alter the supply dynamic by reducing or increasing the amount of oil available to generate the most lucrative price for the cartel.