The e-mini Natural Gas Contract

The natural gas that is traded on the Chicago Mercantile Exchange is a U.S. domestic product that is produced on land and in the Gulf of Mexico. Natural gas, that is traded on the exchange, is in gas format and is measured in millions of British Thermal Units (MMBTU). Natural gas was regulated like a utility in the United States until the early 1990’s, which lead to the introduction of the physically settled natural gas contract in 1992. The United States has the largest reserves of natural gas in the world, and has developed an international pipeline system that leads up to Canada and down to Mexico.

Overview

The natural gas e-mini futures contract that is traded on the Chicago Mercantile Exchange is a domestic product that seeks to track the physically settled natural gas contract that is delivered at Henry Hub in Louisiana, in the United States. The e-mini futures contract is a financially settled instrument, that is cash settled based on the difference between the purchase price minus the sales price multiplied by the number of contracts at settlement. The e-mini controls 2,500 mmbtu’s per contract which is approximately 25% of the physically settled contract, which requires the delivery of 10,000 mmbtu’s of natural gas per contract.

Natural gas is used for both heating demand in the winter as well as cooling demand in the summer. Natural gas is clear burning, and can be used to heat water or air to produce a heating effect. Natural gas is also used as a fuel to turn electricity turbines, which are used to generate power. More recently natural gas has become a driving fuel, but there are a limited number of filling stations in the United States which still predominately uses gasoline.

How to Trade

The natural gas e-mini futures contract is cleared through the Chicago Mercantile Exchange, and can be transacted through any commodity broker that has membership capabilities. The contract is traded Sunday – Friday 6:00 p.m. – 5:00 p.m. (5:00 p.m. – 4:00 p.m. Chicago Time/CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT). E-mini contracts are monthly contracts, January through December consecutively.

Price changes that are fundamentally driven are based on the inventory levels that are estimated by the U.S. Department of Energy in the United States. On a weekly basis, on Thursday’s at 10:30 AM ET, the Energy Information releases its estimate of weekly natural gas inventories. The weekly numbers are then revised to form monthly estimates that are used to determine availability for heating and cooling demand.

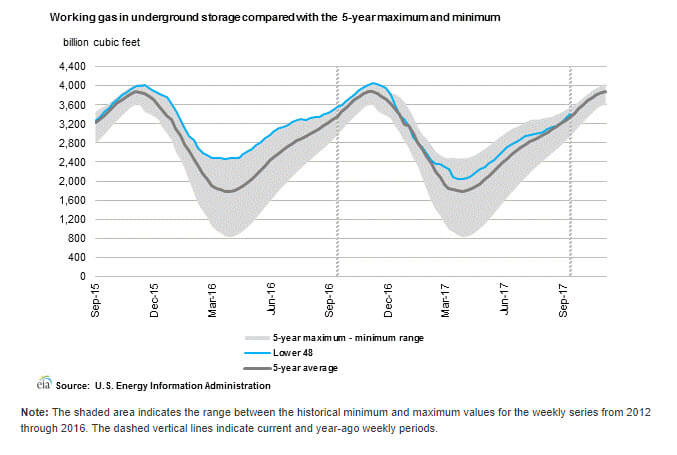

The EIA produces information on inventories and plots stocks levels on a weekly basis showing the 5-year average relative to current inventory levels. Traders will often use this information as a guide to the future direction of natural gas prices. Natural gas inventory levels are subject to a seasonal effect where inventories are increasing during the Summer and into the early fall and then decline through the winter and into the early spring. The Department of Energy provides their own analysis of the natural gas markets, which can be used in conjunction with other forms of analysis.

The production of natural gas is on land and in the sea. The Gulf of Mexico is littered with natural gas production and is subject to supply disruptions when the weather turns for the worse. Hurricanes can destroy a drilling rig, and many times will prompt companies to evacuate their personnel ahead of a storm.

Current weather and weather forecasts will also generate a change in the price of natural gas. The National Oceanic Atmospheric Administration (NOAA) forecasts the weather for the coming 6-10 and 8-14 days. Warmer than normal weather during the summer and colder than normal weather during the winter will generate price volatility.

The e-mini natural gas contract can be volatile. It is used as a speculative tool as well as a contract that natural gas producers and consumers use to hedge their natural gas exposure.