Contracting Triangles – The Favorite Consolidation Patterns

The Forex market spends a lot of time in consolidation. While traders come to the market to profit from its swings, sometimes all they get is just a range.

Ranges aren’t bad, though. Range trading, in fact, is the favorite way for most retail traders to participate in the market.

The problem comes from not being able to tell the difference between ranges and trends. When does one start and when it ends?

Triangles in Technical Analysis

It is said that the currency market spends over sixty-five percent of the time in consolidation. That’s quite a statistic for the most volatile market in the world!

During consolidation times, the best way to trade is to use oscillators and sell overbought and buy oversold levels. However, the idea is to end up on the right side of the market after the range ends.

A great way to speculate on the future market direction is to look for triangles. Out of the many types of triangles that exist, contracting triangles are the favorite consolidation patterns the market forms.

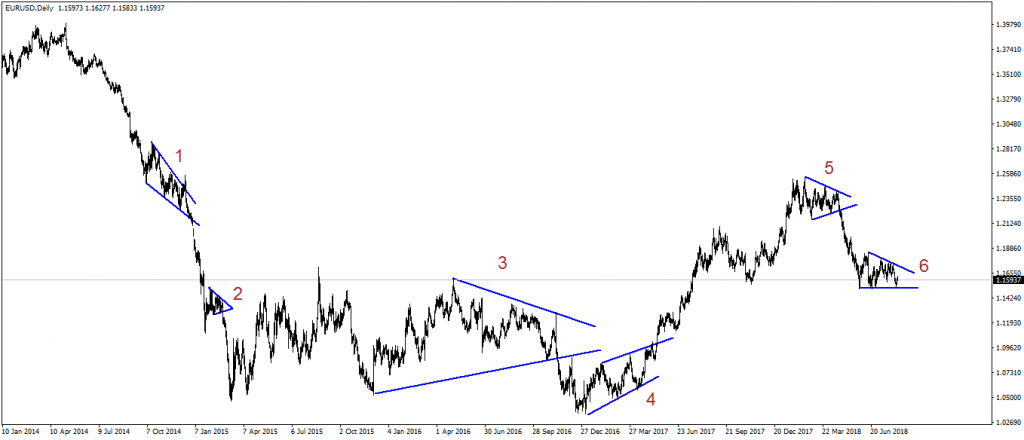

Have a look at the recent EURUSD daily chart. It shows the decline from the 1.40 level to almost parity and the subsequent rally that followed.

During this time, it formed no less than six contracting triangles. Some reversal patterns, some continuation ones, the contracting triangles reveal the market’s direction after the price breaks higher or lower.

The way to trade them is to either wait for the triangle to break or to interpret it as part of a trading theory, like the Elliott Waves.

The six contracting triangles that formed on the EURUSD daily chart illustrate perfectly how often the pattern forms.

In technical analysis, the notion of an ascending or descending triangle exists since traders started to document patterns. During such triangles, the price action builds energy to continue in the direction of the underlying trend.

The one that tried to put an order in triangular formations remains Ralph N. Elliott. The founder of the Elliott Waves Theory, he labeled the triangles with letters and established that all triangles have five segments. Hence, the a-b-c-d-e labeling became the norm, and the b-d trendline the most essential element of a contracting triangle as it shows the triangle’s end.

Conclusion

We’ll treat different types of triangles in future articles, showing how to trade and interpret them. For now, what matters is that triangles do form often, and they are a great trading tool on the FX market.