Introducing Elliott Waves

One of the most intriguing trading theory of them all, the Elliott Waves Theory is almost a hundred-year-old. For such an old concept to stand the test of time and be used when trading currencies, it’s quite a wonder.

But a quick look at what it claims, explains why it is one of the most powerful trading theories ever developed. It interprets optimism and pessimism, greed and fear, by counting all market swings on relevant timeframes.

Today’s timeframes that appear on all trading platforms reflect different market cycles as Ralph N. Elliott defined a long time ago.

His idea was revolutionary for its time. An accountant, Ralph Elliott fell in love with the markets during an illness.

Forced to spend time at home, he looked at historical data on the U.S. stock market and documented patterns, waves, actions, and reactions, built cycles, used Fibonacci ratios, and so on. In other words, we put together the basis for the most revolutionary trading theories of all times up to that point.

The theory claims to have an answer for every market move. Using a concept called top/down analysis, an Elliott Waves trader counts the market swings from the highest available timeframe to the lowest one (rarely below the hourly timeframe, though).

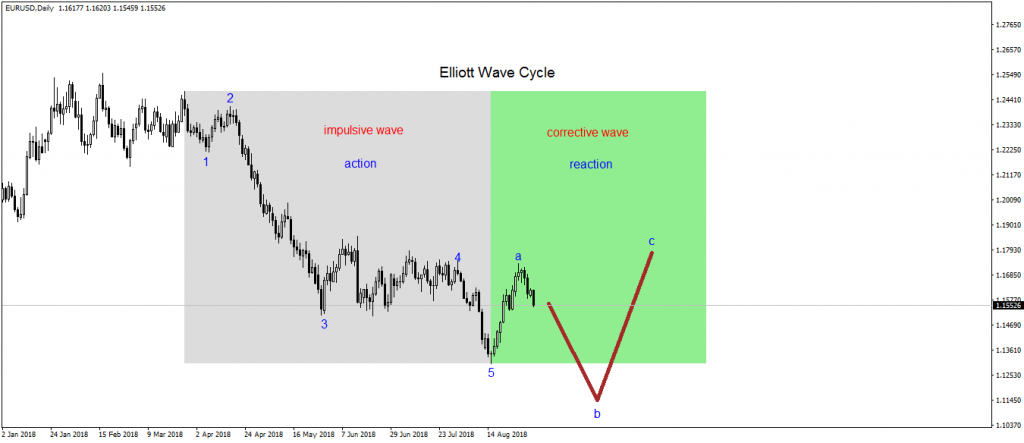

The ups and downs seen on a timeframe represent cycles, and each cycle is made out of an action and its reaction. Hence, one part of a cycle is the action, and the other one the reaction.

Elliott used the names impulsive and corrective to explain the action and reaction when the market moves. Moreover, he used numbers to label the impulsive waves, and cycles to label the corrective ones.

The image above shows the recent EURUSD on the daily timeframe. One possible Elliott count that explains an Elliott cycle is to label the move lower from the 1.25 area to 1.15 as an impulsive wave (1-2-3-4-5) and the other one a corrective wave (a-b-c).

Hence, a cycle that shows the market’s action and the reaction is labeled 1-2-3-4-5-a-b-c. So far, nothing complicated.

However, things become quite sophisticated as each 1-2-3-4-5 may be only the first wave of a more significant degree cycle. Or, the third wave. Or even the fifth wave. And so on.

Conclusion

We’ll continue on this educational part of our website, adding to the Elliott Waves Theory more and more details. The idea is to build one of the most comprehensive approaches to trading with the Elliott Waves, as it holds the key to “mapping” all the market activity on any currency pair.