How to Use an Oscillator Efficiently

Oscillators have a special place in technical analysis. Since the Personal Computer (PC) appeared, traders suddenly realized they could use the computing power to build sophisticated oscillators using math formulas and historical data.

It is no surprise most of the technical indicators we know and use today come from the late 1970’s or 80’s. The RSI (Relative Strength Index), for instance, the most popular oscillator among retail Forex traders, was developed during those years too.

But this article isn’t about the RSI. Instead, it is about how to use an oscillator, any oscillator, efficiently.

A Different Way to Look at Oscillators

Oscillators are known for showing overbought and oversold areas. They work great in ranging environments when traders buy oversold and sell overbought.

But trading isn’t that easy. In fact, selling overbought and buying oversold leads to terrible results when the market breaks the range. Traders remain trapped in the wrong direction without the possibility of getting out quickly.

As any oscillator shows overbought and oversold levels, the idea is to use the areas differently. If traders use the oscillators to sell overbought and buy oversold, why not doing the opposite and profit from the time the oscillator remains overbought and oversold.

If the oscillators show ranges, it means that during the time they stay overbought or oversold, the price tends to trend. Hence, a trading opportunity arises.

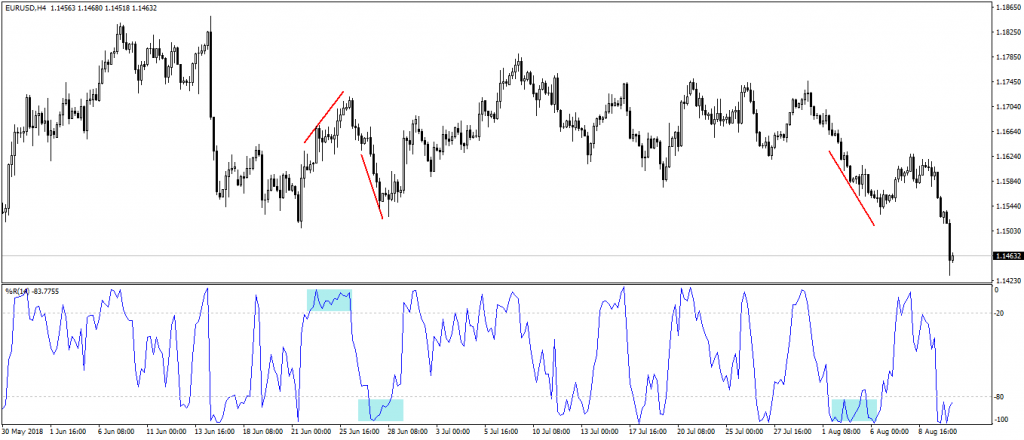

Above is the recent EURUSD price action on the four-hour timeframe. The price, as it appears, ranged for quite some time.

However, even during the ranging period, small rallies appeared. And, funny enough, they happened with the oscillator being overbought or oversold.

The oscillator used here is the Williams’ Percent Range. It travels only in negative territory and shows overbought levels while above -20 and oversold while below -80.

As the chart shows, the price rallied during the marked areas, proving that an efficient way to use the oscillator is actually to buy overbought and sell oversold.

Conclusion

Savvy traders call this strategy buying strength and selling weakness. It differentiates them from the crowd and gives an opportunity to speculate using a different approach.