Wedges as Reversal Patterns

A well-known pattern in technical analysis, the wedge appears at the end of strong trends. But, not only.

While showing reversing conditions, it isn’t mandatory for the wedge to form at the end of a trend. Moreover, it doesn’t always reverse a trend. For this reason, a stop-loss order is mandatory when trading a wedge.

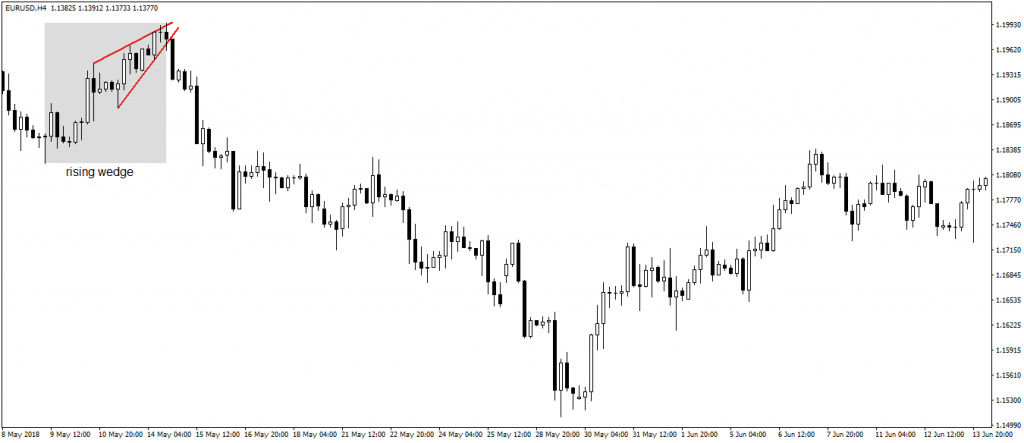

The saying goes that rising wedges fall, and falling wedges rise. What this means is that a rising wedge forms at the end of a bullish trend, and, when the price breaks it, the market reverses. Consequently, a falling wedge appears at the end of a bearish trend, and, after the price breaks the upper trendline, the market reverses.

A wedge shows the price hesitating in making new highs or lows. Depending on the timeframe, it may take a lot of time until the reversal conditions are in place.

The hesitation becomes visible as the market makes a series of higher highs and lower lows, but only marginal ones. Connecting the higher highs and lower lows give the shape of the wedge.

On the top left of the chart above is a rising wedge. While the market makes three consecutive higher highs, it forms only marginal ones. The same is valid with the higher lows, and, connecting them, the shape of the wedge appears.

While most of the times a wedge appears at the end of a trend, marking a top or a bottom, it could form in the middle of it. The Elliott Waves Theory explains this as the market forming the c-wave in a flat pattern. Also called a terminal impulsive move, by the time the wedge reverses, the price will fully retrace the pattern.

To trade a wedge, traders focus on the lower trendline (in the case of a rising wedge) or the upper one (in the case of a falling wedge). When the price breaks the wedge, they place a stop-loss order at the maximum point of a rising wedge or the minimum of a falling one, while targeting full retracement most of the times.

Conclusion

Rising and falling wedges belong to classic technical analysis concepts. Together with other patterns like the head and shoulders, double and triple bottoms, etc., they reverse even the strongest trends.