Bitcoin ready for the upside; CoT shows short positions declining

After rallying two days from 6,350 to 6,725 on August 23 and 24, Bitcoin is completing its third day on consolidation mode between 6,680 and 6,770. On Monday, BTC/USD is trading 0.25% positive at 6,727.

Investors are waiting for the right moment to buy the cryptocurrency as the latest Commitments of Traders (CoT) published by the Commodity Futures Trading Commission (CFTC) on August 24 showed that bearish positions for non-commercial contracts of Bitcoin futures are on the decline.

Net position on BTC futures declined by 1,266 on the week ending on August 21. Short positions fell to 3,426 after losing 210 contracts from the previous week. Long positions rose by 56 contracts to 2,160.

The market is still short on Bitcoin with a -1,266 reading, however, it is a recovery from the -1.926 recorded on June 5. The change indicates an improvement for Bitcoin bulls and a recovery from bearish sentiment.

Analysts at LMAX doesn’t believe in the upside too much, however, as they said that “despite recovery attempts, the downtrend remains firmly intact, with a fresh lower top sought out below $8,500, to be confirmed on a bearish continuation below the 2018 low. Only a break back above $8,500 would negate.”

As mentioned before, BTC/USD is trading in consolidation mode for the third day in a row. Currently, Bitcoin is 0.25% positive at 6,727. The pair looks ready to test the 6,840 area previously tested on August 22.

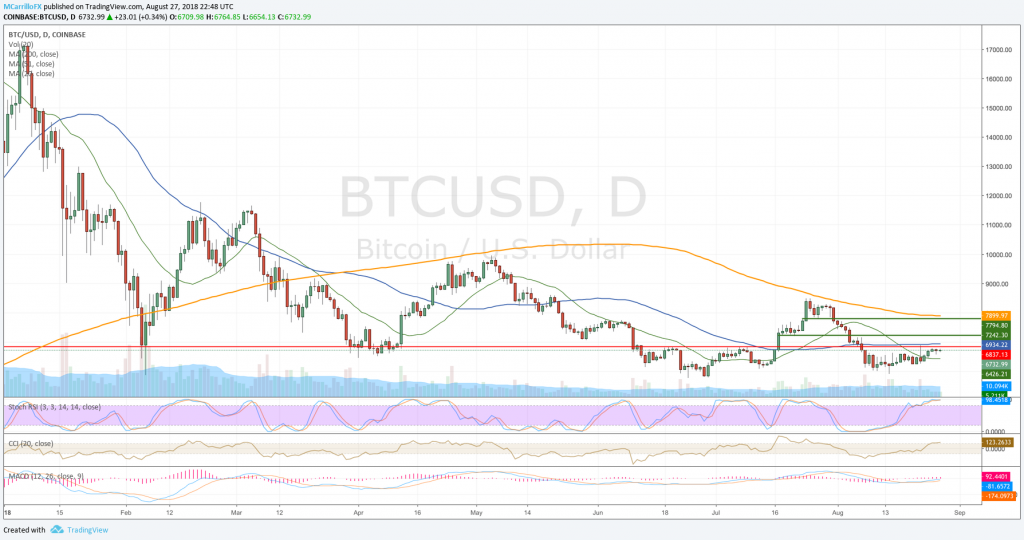

BTCUSD daily chart August 27

However, the real frontier lies at the 50-day moving average line at 6,935. Technical conditions are improving for the BTC/USD. MACD is still below its midlines, but it is recovering and heading to the middle. RSI is showing kind of improvement too.

Above the 6,935, next resistances will be found at 7,240, 7,795 and the 200-day moving average at 7,900. To the downside, if the 6,840-6,940 rejects Bitcoin, it will face support at 6,640, then 6,250 and the 6,000 area.