Busy day: Economic data and sentiment send dollar up while stocks down

Busy day in the economic calendar on Thursday as investors have to digest a lot of fundamental numbers across the world. From New Zealand to the United States and Argentina, the Dollar is up, while equities down.

First on the day, the Australian building permits came worse-than-expected with a 5.2% decline in July, the double of the 2.5% drop expected by the market and almost lost the 6.4% increase in June.

The AUD/USD extended declines for the third day, and it is currently trading 0.40% down on the day at 0.7280. The pair looks ready for a new test of the 0.7240 support.

In Switzerland, the KOF leading indicator declined from 101.7 in July to 100.3 in July, below expectations of 101.1. The USD/CHF bottomed at 0.9690 on Thursday after four negative days in a row. The pair is 0.1% positive at 0.9715.

CPI in Germany came in line with expectations as prices remained at 2% YoY and increased 0.1% MoM in August. Harmony index of CPI came below expectations at 1.9% year over year.

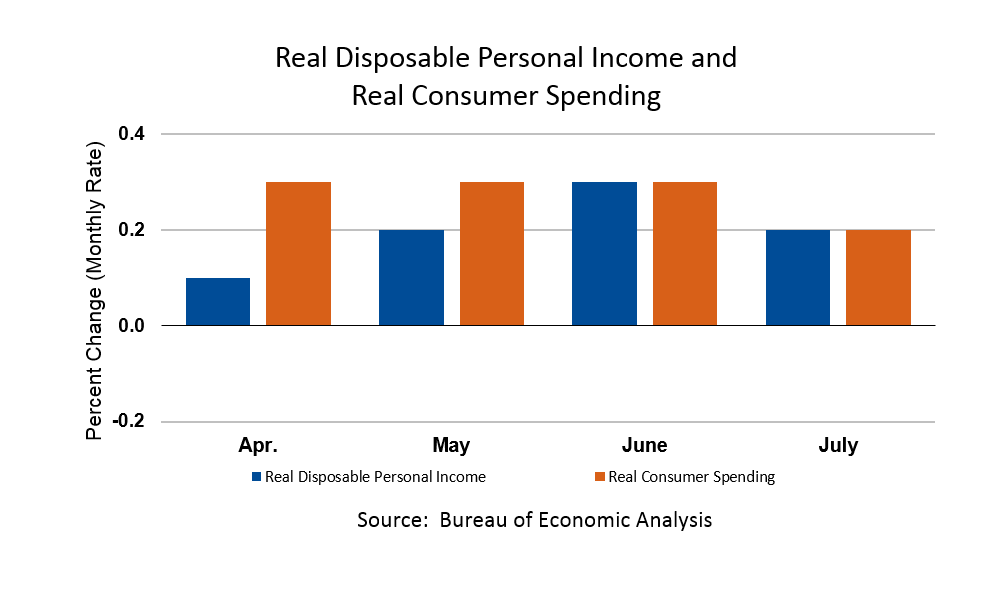

In the United States core personal consumption expenditures, price index, rose to a 2.0% YoY growth in July, in line with expectations. Personal income rose 0.3%, while personal spending rose 0.4% in July.

Personal outlays United States August

“The increase in personal income in July primarily reflected increases in wages and salaries, personal dividend income, and rental income,” said the official report. “Personal outlays increased $52.7 billion in July. Personal saving was $1,048.1 billion in July and the personal saving rate, personal saving as a percentage of disposable personal income, was 6.7 percent.”

Also in the United States, initial jobless claims declined to 213K in the week of August 24. Continuing jobless claims dropped to 1.7 million in August 17 week, better than expected.

The EUR/USD is trading negative for the first time in five days as the pair lost the 1.1700 level and is trading 0.41% down on the day at 1.1660.