Dollar extends its decline amid Trump threatening to the Fed

The Dollar index is traded down for the third day in a row on Monday as investors digested United States president Trump remarks on what the Federal Reserve should do with its monetary policy and how the FOMC should avoid hike rates.

President Trump told CNBC that he is “not thrilled” with Federal Reserve Jerome Powell for raising interest rates. He also stated that he “should be given some help by the Fed,” and affirmed he would criticize the Fed if they continue to raise rates.

The economic calendar is light this week with the central banker symposium at Jackson Hole as the only main event. Federal Reserve Jerome Powell is scheduled to talk on Friday at 10 a.m.

The DXY is trading negative for the third day and on Monday, it is closing the day at 95.70, 0.42% down the day. Since its peak on August 15 at 97.00, the index has lost 130 pips or 1.3% in just three days to current daily lows at 95.70.

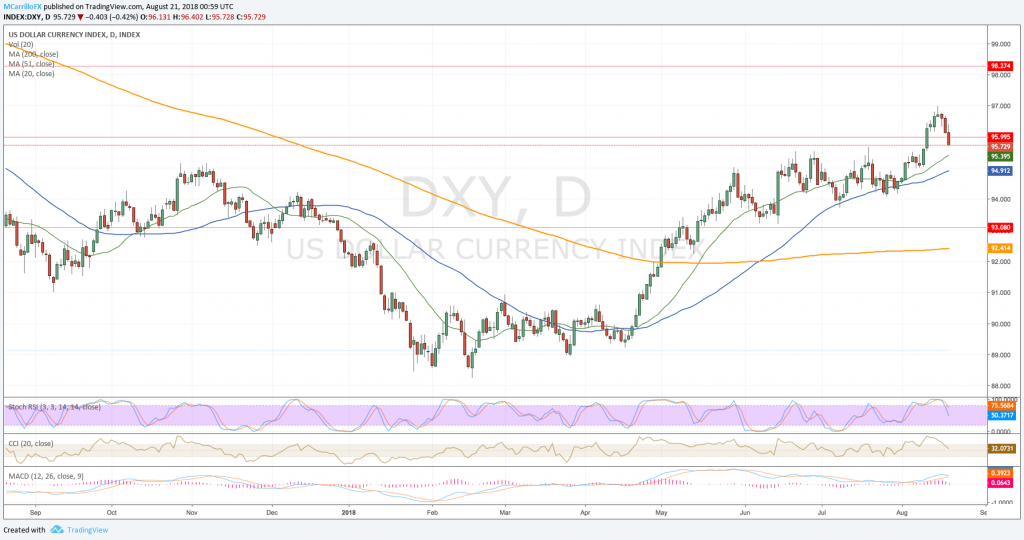

Dollar index DXY daily chart August 20

The Greenback is now testing the critical 95.60 support that served as a container for the unit in June, July and the beginning of August.

Technical conditions for the dollar index remains bullish but turning to the downside. Moving averages are still aligned to the north, and the MACD is above its midlines. However, the RSI is suggesting that the recent uptrend is exhausted.

To the downside, if the unit breaks below the crucial 95.60, it will find next supports at the 20-day moving average at 95.35, the 50-day moving average at 94.90 and then the 94.00 area.

To the upside, the index should see levels above the 95.60 area to give hope to bulls. Above there, the next resistance will be the 97.00 high. Then, 97.70 and 98.40 are the identified selling areas.