EUR/USD down to 1-year low as US CPI accelerates

The US dollar is trading higher on Friday following the upbeat consumer price index in the United States in July. Against the Euro, the dollar is posting significant gains, and the EUR/USD is now trading at its lowest level in more than a year.

Consumer price index in the United States rose 0.2% between June and July, a number in line with expectations and an acceleration from the 0.1% increase performed the previous month.

Year over year, Inflation decline to 2.9% in July, the same of June, but below the 3.0% expected by the market.

Inflation excluding food and energy rose 0.2% monthly in July, in line with expectations. ON the year, inflation accelerates to 2.4% in July, above 2.3% expected and posted in June.

“The all items index rose 2.9 percent for the 12 months ending July, the same increase as for the period ending June,” the official report said. “The index for all items less food and energy rose 2.4 percent for the 12 months ending July; this was the largest 12-month increase since the period ending September 2008. The food index increased 1.4 percent over the last 12 months, and the energy index rose 12.1 percent.”

EUR/USD smashes 1.1500 and trade at 1-year low

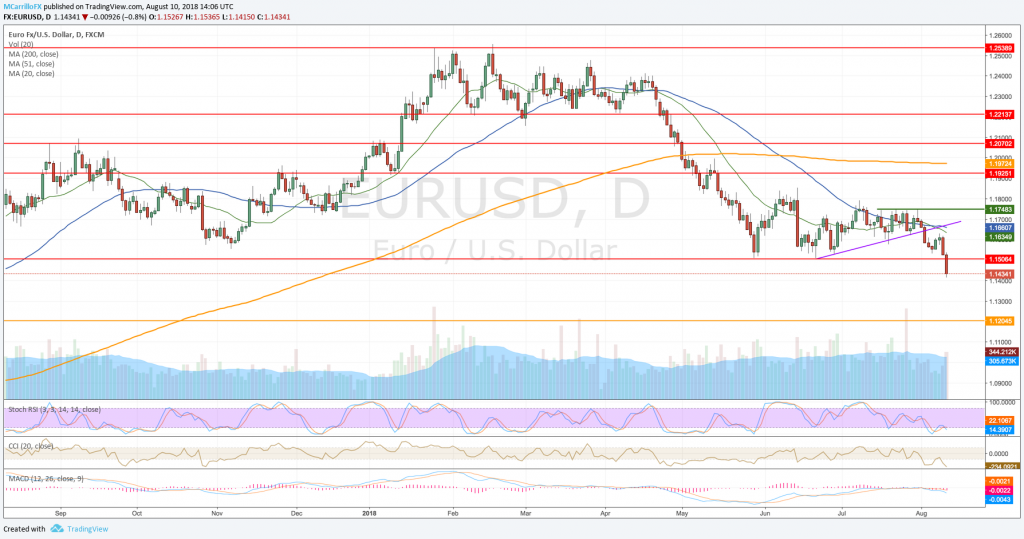

EURUSD daily chart august 10

EUR/USD is trading 0.86% down on the day at 1.1426 as the EUR/USD is under pressure following a better than expected inflation in the United States. Expectations of a rate hike have increased in the latest minutes as a higher than expected inflation would exacerbate Federal Reserve rate hike intentions.

The euro’s decline failed to sustain the 1.1500 area, and it is now trading at its lowest level since July 14, 2017. In the last two days, EUR/USD lost 1.7%. The cross is 2.3% down in August.

Technical conditions for the EUR/USD are weak, and momentum has turned sharply lower, Relative Strength Index (RSI) is showing oversold conditions. MACD is also pointing to the south.

Next supports are at 1.1440, 1.1380 and 1.1290.