EUR/USD finds support and gets back above 1.1600

The Euro is joining the quiet and low volume environment of the labor day holiday in the United States as the EUR/USD stopped a two negative trading day in a row to perform a positive day at the open of a busy week.

Previously on the day, Markit published its European manufacturing PMI reports. The eurozone manufacturing PMI was unchanged at 54.6 between July and August, in line with expectations.

In Germany, PMI manufacturing declined to 55.9 in August from 56.1 in July. It was below expectations as the market waited for the PMI indexes to remain unchanged.

Remember that all figure above 50 indicates expansion while a sub-50 number shows a contraction in the index.

According to FXStreet analyst Pablo Piovano, the dollar lack of direction is allowing the EUR/USD to make some gains, “looking ahead, the pair is expected to remain under scrutiny ahead of Fedspeak and key releases in the US docket, including Friday’s Non-farm Payrolls, while Italy and the German-Italian yield spread appear to have returned to the investors’ radar.”

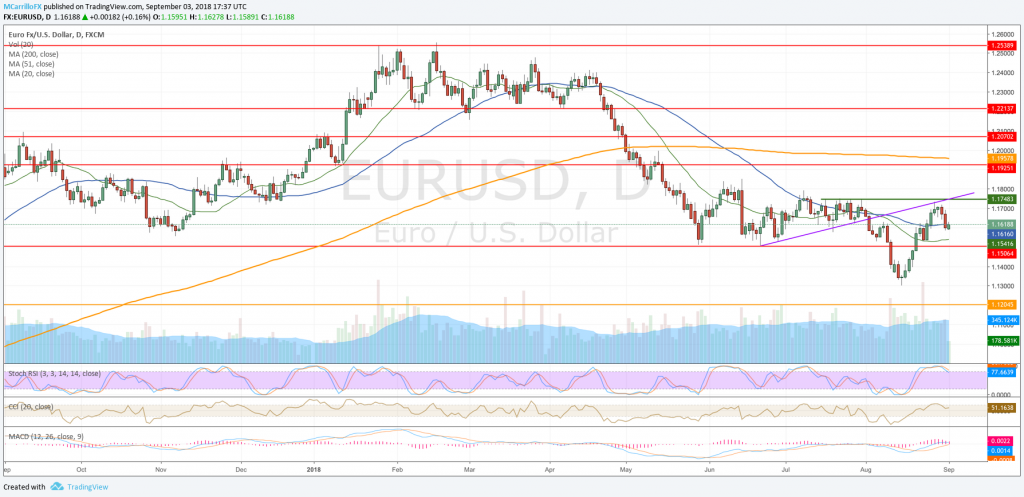

After falling 130 pips from August 30 at 1.1720 to trade as low as 1.1585 on Monday, the EUR/USD found support at that level, and it is now attempting to consolidate prices above the 1.1600 area.

EURUSD daily chart Sept 3 T

Currently, EUR/USD is trading 0.17% positive on Monday t 1.1620. Technical conditions are neutral with overbought levels in the short term. The pair is still trading in a tight range around the 50-day moving average.

To the upside, if the pair consolidates levels above the 1.1600 price, it will face resistance at 1.1700. Above there, check the 1.1750 critical level. To the downside, if the pair breaks below 1.1685, it will find support at the 20-day moving average at 1.1540 and then, the 1.1500 price.