EUR/USD tests 50-day moving average on FOMC minutes

Euro is extending its advance against the US dollar as it is trading positive for the sixth day in a row. The pair is joining the dollar weakness on Trump remarks on interest rates and FOMC minutes.

The Federal Reserve released its minutes of the committee meeting held on July 31 and August 1, 2018. As highlights, the FOMC generally expected further gradual hikes, while the board is noting considerable momentum in household and business spending.

The Fed is expecting a GDP growth slowdown in the second half of the year, but it will remain above potential. The Board sees trade, housing and emerging markets as downside risks.

Talking about the labor market, the staff considers that “the unemployment rate was projected to be a little higher over the next few quarters than in the previous forecast, but it was essentially unrevised thereafter.”

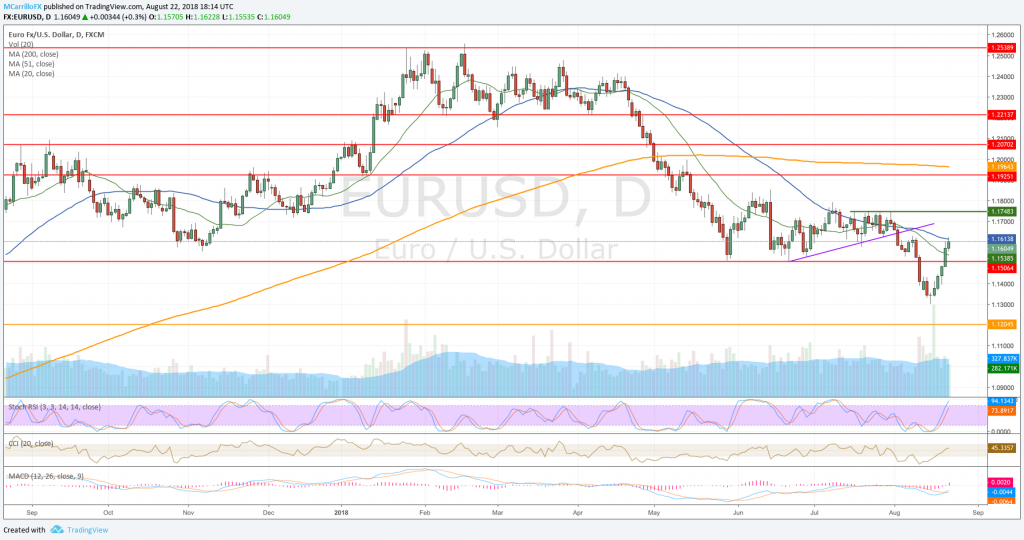

After rallying 320 pips from August 15 bottom at 1.1300, the EUR/USD is testing the 50-day moving average at 1.1615 as the pair is trading positive and breaking significant levels such as the 1.1500 level on August 21 and the 20-day moving average at 1.1540 on August 21 too.

EURUSD daily chart August 22 L

EUR/USD is currently trading 0.30% positive on the day at 1.1600. Technical conditions for the cross are improving to the upside as the MACD is below its midlines but turning higher. RSI is also wooing the current uptrend is healthy, but moving averages are still pointing to the south.

IF the euro consolidates levels above the 50-day moving average, it will find next resistance at 1.1750. Above there, check for 1.1840 and 1.1925.

To the downside, If the pair got a rejection from the 1.1615, it will get back to the 1.1500 area. If broken, it will go to August 15 lows at 1.1300.