EUR/USD up after US GDP rose 4.1%, fastest rate in four years

The EUR/USD has reacted to the upside following the weaker than expected US Gross Domestic Product for the Q2, according to the first release published by the Bureau of Commerce today.

The US economy is growing at its fastest rate in four years as the GDP has risen 4.1% in the second quarter, in line of expectations and an upgrade to 2.2% posted in the previous quarter. First quarter data was revised up to 2.2% from previous 2.0%.

However, Donald Trump’s leak was wrong as 4.1% is not exactly the 5% signaled by the White House.

Robust consumer consumption is also positive and so are other components. Business investments rose by 7.3%; while experts advanced 9.3%, both upbeat figures. Most of that acceleration was due to consumption and exports.

Christopher Vecchio, Sr. Currency Strategist at DailyFX.com, affirmed in his Twitter account that the “headline Q2’18 US GDP is nice on the surface at +4.1%, but the major surge in exports is a one-off due to the tariffs (soybean exports up ~50% y/y), so trade will likely be a drag on US growth in the second half of the year.”

A kind of buy the rumor, sell the fact, it may not have been as good as speculated by White House leaks early in the week, but the reading is excellent. The limited reaction may be explained as the market already priced it in.

In the forex sphere, USD is little changed across the board after a modest downtick.

EUR/USD recovers earlier losses and it’s up above 1.1640

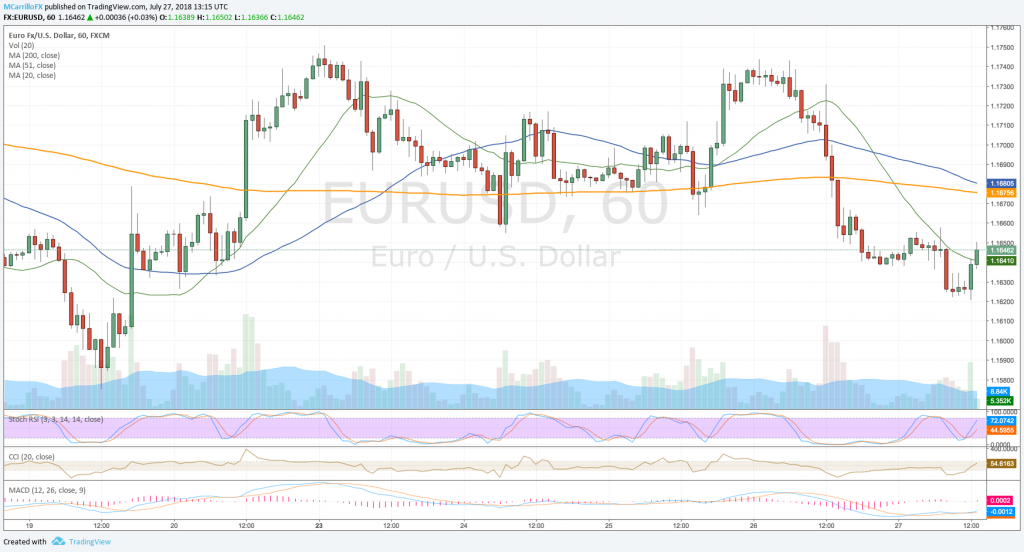

EURUSD hourly chart July 27

The EUR/USD has reacted to the upside following US GDP as investors are disappointed by the number, though it was the best reading in four years, but it was less than the 5% leaked by the White House.

EUR/USD ejected from 1.1620 right at the GDP release to trade above the 1.1650 area. The cross has now recovered earlier losses, and it is posting 0.05% gains so far today.

If the pair sustains gains above 1.1650, it may find resistance at 1.1680, where 20 and 50 days moving averages are together. Then, check the 1.1750 critical resistance. Above that, a stop-loss triggering may propel the euro-dollar to 1.1800 quickly and 1.1850 in the next hours.

To the downside, 1.1620 is the immediate support, below there, check for the 1.1575 and 1.1515 as possible buying zones.