FOMC game changer: Concern on Trade policy; 7 hike rates in 2018 and 2019

The minutes from the Federal Reserve last FOMC meeting on June 12-13 showed that the Fed is concerned about the trade-war between the US and the world. Also, experts believe the Fed hinted four interest rate hikes in 2018.

First of all, remember that the Federal Reserve decided to raise its fund rate to 2% in its last FOMC meeting on June 13. Next meeting will be held on August 1st.

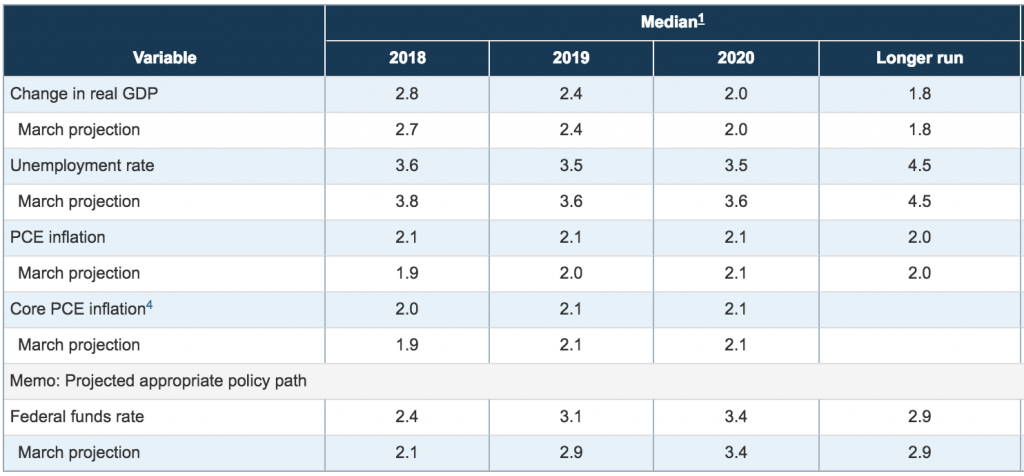

Advance release of table 1 of the Summary of Economic Projections to be released with the FOMC minutes

The FOMC saw that price moves support their outlook for a 2% inflation. Also, the Fed is welcoming the fiscal policy as it is helping the economic growth. However, running economy too hot bring risks of an economic downturn.

“On the upside,” the minutes said, “recent fiscal policy changes could lead to a greater expansion in economic activity over the next few years than the staff projected.”

“On the downside, those fiscal policy changes could yield less impetus to the economy than the staff expected if, for example, the marginal propensities to consume for groups most affected by the tax cuts are lower than the staff had assumed.”

Fed policymakers saw downside risks from emerging and European markets. At the same time, they are concerned by threats from a trade war. The trade as a concern has scaled back capital spending.

“However, many District contacts expressed concern about the possible adverse effects of tariffs and other proposed trade restrictions, both domestically and abroad, on future investment activity; contacts in some Districts indicated that plans for capital spending had been scaled back or postponed as a result of uncertainty over trade policy.”

FOMC hinted seven hikes in 2018-19, says Rabobank

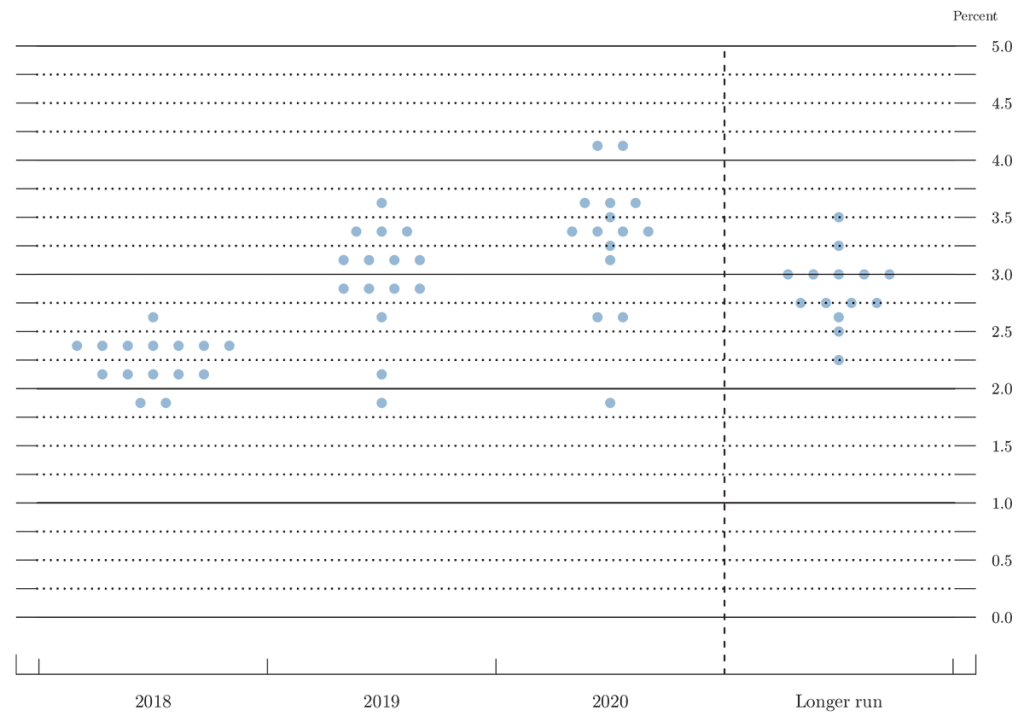

FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate*

Rabobank’s analysts believe that the Federal Reserve hinted four interest rate hikes in 2018 and 3 in 2019 according to a note published recently.

After reading the FOMC minutes, Rabobank said that after watching the “dot plot the fourth hike for 2018 is still hanging in the balance with only a minimal majority among all participants.”

“An escalation of the trade conflicts between the US and other countries” could erode the urgency of a fourth hike.

Dollar index falls on US data and minutes

The Dollar index reacted negatively to the news coming from the ADP and the department of labor firstly, and it failed to recover with the minutes. The DXY fell to 94.20, its lowest level since June 25. The unit is managing to recover some ground and it is trading back at 94.35, 0.22% on Thursday. The index is fighting to recover ground after the declines posted on the week amid news on ECB and Trump.