GBP/USD rejected at 1.2940; The 1.3000 should wait

The British pound is trading lower against the US Dollar as the greenback is performing a revival following some days of weakness. The GBP/USD is currently testing the 1.2800. Brexit fears are back too.

The British government released a note a for no-deal Brexit; The Brexit department published the first of a series of documents advising people and business in the case of a non-deal Brexit. The document was a reality check for cable bulls. However, officials said they remain optimistic that a deal will be reached.

On the no-deal Brexit effects into the Sterling, Rabobank analysts said in a recent article, that “after Fox remarked that there is a 60% probability of no deal before the UK leaves the EU at the end of March 2019, cable hit an 11 month low. It can be argued that GBP was already on the back foot as the market digested that likelihood that, after its August 2 hike, the BoE was likely to stand pat on policy as Brexit neared.”

The dollar index, on the other hand, traded higher on Thursday as the index bounced at the 50-day moving average at 95.00 and it extended recovery to trade above 95.60.

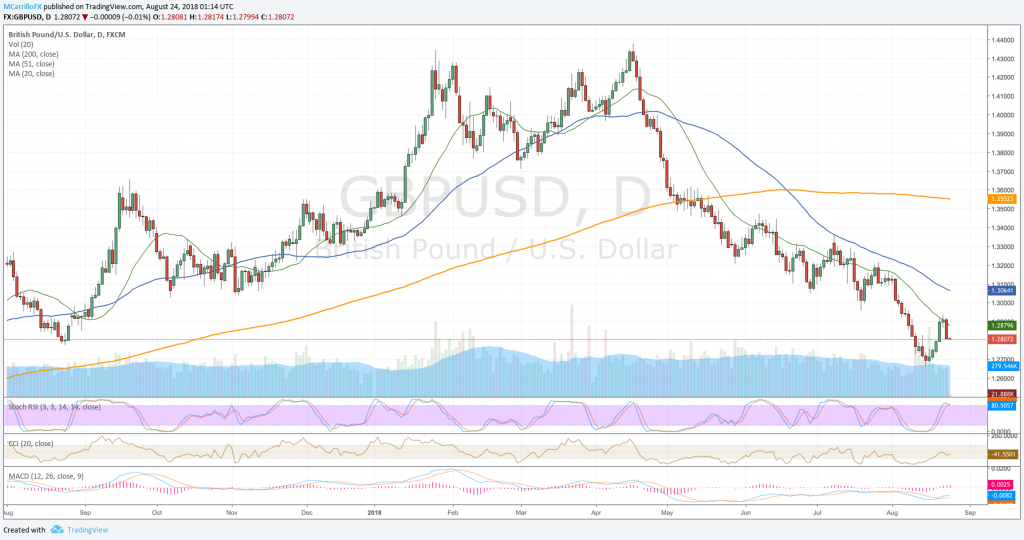

Back to the GBP/USD, the pair fell from 1.2930 levels to trade as low as 1.2800 on Thursday. The cross is also ready to post more declines on Friday. The pair was unable to consolidate gains above the 1.2900 area, and the 20-day moving average helped bears to launch the unit down to the 1.2800.

GBPUSD daily chart August 23

To the downside, if the pair consolidates current levels, it will find next supports at the 1.2770 area and the fundamental 1.2700 area.

To the upside, the GBP/USD would find resistances at 1.2930 and the critical 1.3000 level. Above there, check the 50-day moving average at 1.3065.