GBP/USD under pressure amid no-deal Brexit

The British Pound fell under eruption after the UK International Trade minister Liam Fox said that a no-deal Brexit has a 60% chance of happening. The GBP/USD is trading at 11-month low.

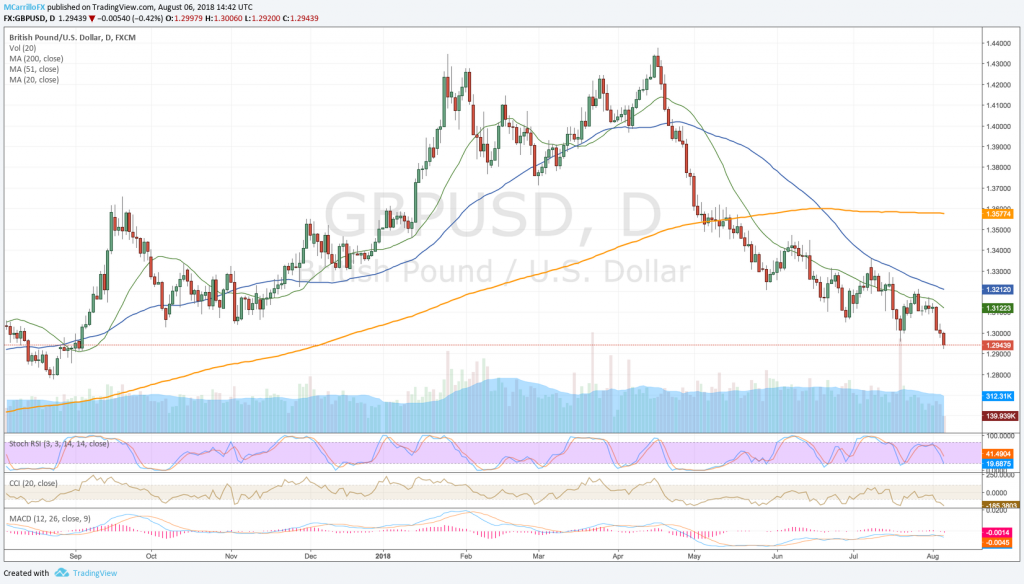

GBPUSD daily chart August 6

UK international trade minister Fox said that a no-deal on Brexit is more likely than a deal, following previous comments from Bank of England Mark Carney. Market is concerned about the political ability of the parts to reach an agreement. A warning signal for the global economy.

Carney acknowledged that the risks that Brexit takes place without a deal were too high for comfort.

The GBP/USD reacted with violence and it fell to lows since September 2017 at 1.2920. The cable is performing its third negative day in a row after the pair 1.55% from 1.3130 on August 2, to break below the 1.3000 critical support and price at the mentioned low on Monday.

The sterling is currently trading 0.50% negative on the day at 1.2935. Technical indicators are suggesting further losses with moving averages pointing to the downside, MACD below its midlines and the RSI showing weak conditions.

The Sterling is testing the 1.2940 area. To the downside, the pair would face supports at 1.2860 and the 1.2800 area, which corresponds with a 61.8% retracement of the rally since the flash crash low in October 2016 at $1.1840.

Senior Analyst at Commerzbank Axel Rudolph said that “over the next few days the risk remains on the downside while trading below the 1.3173 July 30 high”. Rudolph affirmed that “failure at 1.2925 would put the August 2016 low at 1.2866 on the cards”.

To the upside, the GBP/USD needs a close above the 1.3000 to recover its mojo. Above there, cable would find resistance at the 20-day moving average at 1.3120, and the 50-day moving average at 1.3220.