Japan machinery orders crush expectations while USD/JPY fails the break

Machinery orders jumped 16.5% YoY in May, the double than the 8.6% expected by the market and an acceleration of the growth rate from 9.6% gain in April according to a press release published by the Cabinet Office.

Month over month, machinery orders declined 3.7% in may, better than the expected decline of 5.5%, but well below the 10.1% increase performed on April.

As per context, it seems there is better consumer confidence down under lately as Australian Westpac Consumer Confidence index rose 3.9% in July from 0.3% in June according to a release of the Faculty of Economics and Commerce Melbourne Institute.

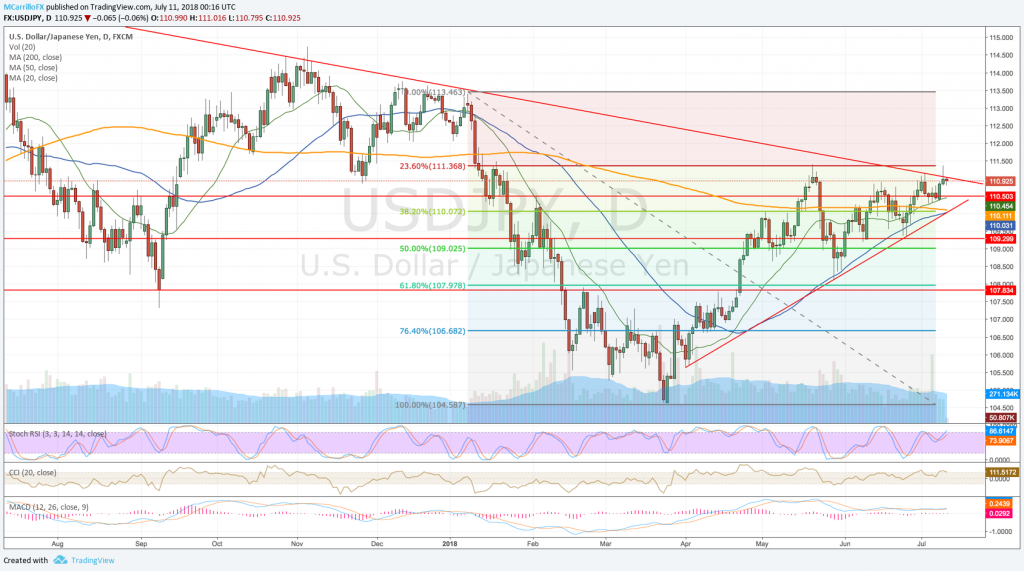

USD/JPY fails to sustain the break above the dynamic resistance

The US dollar made a significant movement against the Japanese yen as it broke above a long-term dynamic resistance coming from December 2016, November 2017 and January 2018 at 111.10. However, it failed.

Watch the USD/JPY daily chart with the break and return to the triangle:

The USD/JPY performed a failing break on Tuesday as it rallied almost all the day to reach prices as high as 111.35. However, the dollar wasn’t able to sustain gains versus the Yen, and it returned to the symmetrical triangle, and it closed below the dynamic resistance at 111.10.

The USD/JPY is currently trading 0.11% negative on Wednesday at 110.90. The pair is supported in the short term by the 110.80 level. However, the middle term refers to the 20-day moving average at 110.45 as a level to catch up.

Technical conditions suggest an upside continuation for the dollar-yen; however, as moving averages are neutral, and the pair returned into the triangle the forecast is now uncertain.

To the downside, the pair should close below the 111.10 level to give bears some hope. Supports are at 110.85, 110.40 and 110.00.

To the upside, the next resistance is June 21 high at 111.40, then 112.00 is the next natural selling zone. However, the bulls are confident that there is room to go until January highs around 113.50.