Mix US inflation sends the Dollar to the downside

The United States reported inflation for June mostly in line with expectations. The monthly number came below expectations, but the always important CPI ex-food and energy was reported as expected.

Following the news, the US Dollar reacted to the downside as the DXY fell from daily highs close to 95.00 to 94.70. EUR/USD bounced off lows and it is now trading positive on the day.

Prices in the United States rose 0.1% between May and June, a number below market’s expectations of 0.2% and a slowdown from the 0.2% inflation of May. Year over year, the US Department of Labor Statistics reported inflation of 2.9% between June 2017 and 2018, in line with market expectations but a slight acceleration from May number of 2.8%.

“The indexes for shelter, gasoline, and food all rose to lead to the seasonally adjusted increase in the all items index,” the press release said. “The food index increased 0.2 percent in June, with the indexes for food at home and food away from home both rising 0.2 percent. Despite a 0.5-percent increase in the gasoline index, the energy index declined 0.3 percent, with the indexes for electricity and natural gas both falling.”

The price index for all items excluding food and energy rose 2.3% in the last twelve months to June, in line of the market expectations and also an acceleration from the 2.2% interannual reported in May.

“this figure has been generally trending upwards since it was 1.7 percent for the period ending November 2017. The shelter index rose 3.4 percent over the last 12 months, and the medical care index rose 2.5 percent. Indexes that declined over the past 12 months include those for airline fares, new vehicles, used cars and trucks, and communication.”

EUR/USD bounces at 1.1650 amid US CPI data

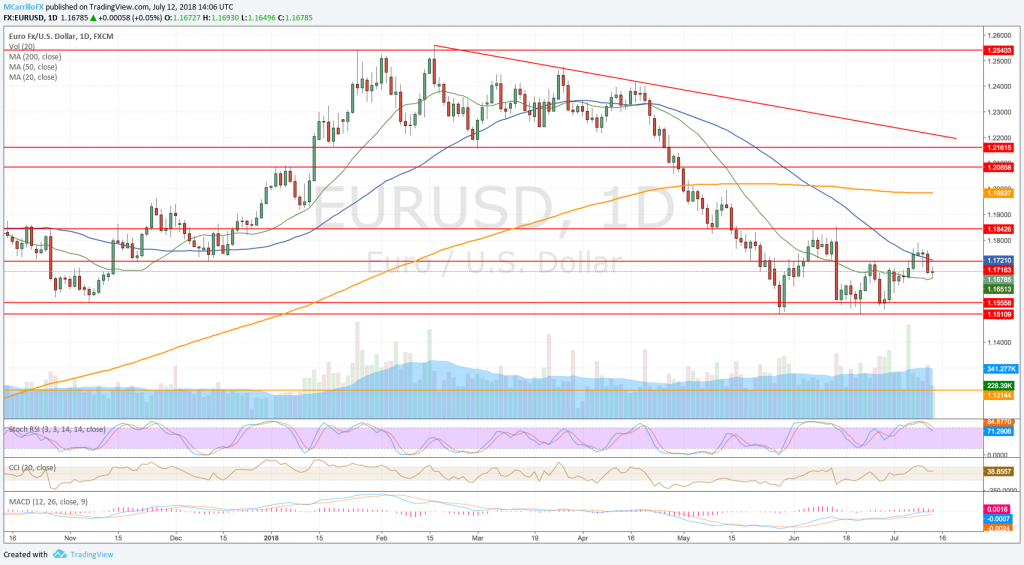

EURUSD daily chart July 12

The EUR/USD bounced off 1-week lows around 1.1650 after the inflation data, and the pair recovered to 1.1690 as initial reaction of the release.

However, the euro retreated from highs to trade t current levels. The EUR/USD is now trading flat on the day at 1.1675, the 20-day moving average supports the pair but under the bearish pressure of the 50-day moving average.

In forex terms, the pair failed to extend recoveries above the 1.1800 area on July 9, and it is now back inside the previous range between 1.1510 and 1.1710.