Ugly housing data sends the dollar down

The United States reported a weak housing data on Wednesday and investors reacted selling the US dollar. EUR/USD rebound from lows, while the Japanese Yen is advancing now against the greenback.

The US Census Bureau reported that housing starts dropped 12.3% in June to reach an annual rate of 1,173.000. The number is well below the 2.2% decline expected by the market and the revised down number of May of 2.4% increase.

The press release highlighted that June number is ” 2.2 percent above the June 2017 rate of 1,234,000. Single-family housing completions in June were at a rate of 862,000; this is 2.3 percent below the revised May rate of 882,000. The June rate for units in buildings with five units or more was 393,000.”

Building permits fell 2.2% between May and June to an annual rate of 1,257,000. Well below the 6% increase expected by the market but an improvement from the 4.6% decline posted in May.

Year over year, the agency reported that June number is “3.0 percent below the June 2017 rate of 1,312,000. Single-family authorizations in June were at a rate of 850,000; this is 0.8 percent above the revised May figure of 843,000. Authorizations of units in buildings with five units or more were at a rate of 387,000 in June.”

USD/JPY falls following weak US housing data

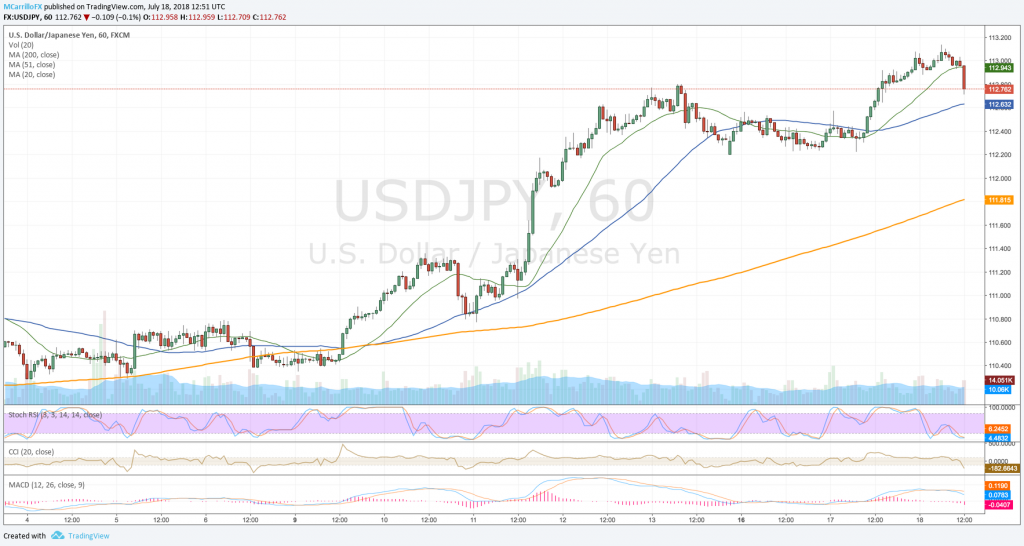

USDJPY daily chart July 18

On the forex sphere, while the US dollar was trading in consolidation mode around 113.00 against the Japanese Yen, ugly US housing data push the greenback under pressure, and it fell to trade at intra-day lows around 112.70.

After the news, the USD/JPY is trading 0.10% negative on the day at 112.75. Technical conditions are suggesting some exhaustion for the bullish USD/JPY trend. RSI and MACD are aligned to the south, and moving averages are now turning to the downside. Thought it is still too soon to say that.