US added less ADP private jobs than expected; jobless claims up

The United States added 177K new private jobs in June according to the latest report from the Automatic Data Processing, or ADP. The number came short of expectations, and it implies a decline from the 189K new jobs added in May.

Monthly Change in Nonfarm Private Employment June 2018

Private-sector employment increased by 177,000 from May to June, on a seasonally adjusted basis. Large corporations added 69,000 new jobs in June, while midsize companies hired new 80,000 positions.

By sectors, the Goods-producing industry generated 29,000 jobs, including 13,000 positions in the construction and 12,000 in the manufacturing sector.

The Service-providing sector added 148,000 new jobs, including 46,000 in the education and health industry, 33,000 in leisure and hospitality and 24,000 in transportation, trade, and utilities.

June has been the second lowest month since November 2017, with only the 170,000 new jobs posted in April as a lower figure.

Jobless claims rose

Initial jobless claims rose to 231,000 in the week of June 30 according to the US Department of Labor. The second consecutive week with increases. The number came above expectations of a decline to 225,000 jobless claims.

Continuing jobless claims rose to 1,739,000 in the June 23 week, a big jump from the 1,707,000 reached the previous week. The figure was above expectations of 1,720,000.

ISM non-manufacturing PMI rose above expectations

The ISM non-manufacturing PMI rose to 59.1 in June from 58.6 in May according to the Institute for Supply Management. June numbers came above expectations of 58.3; however, Employment component dropped to 53.6 from 54.1.

Dollar index falls on US data

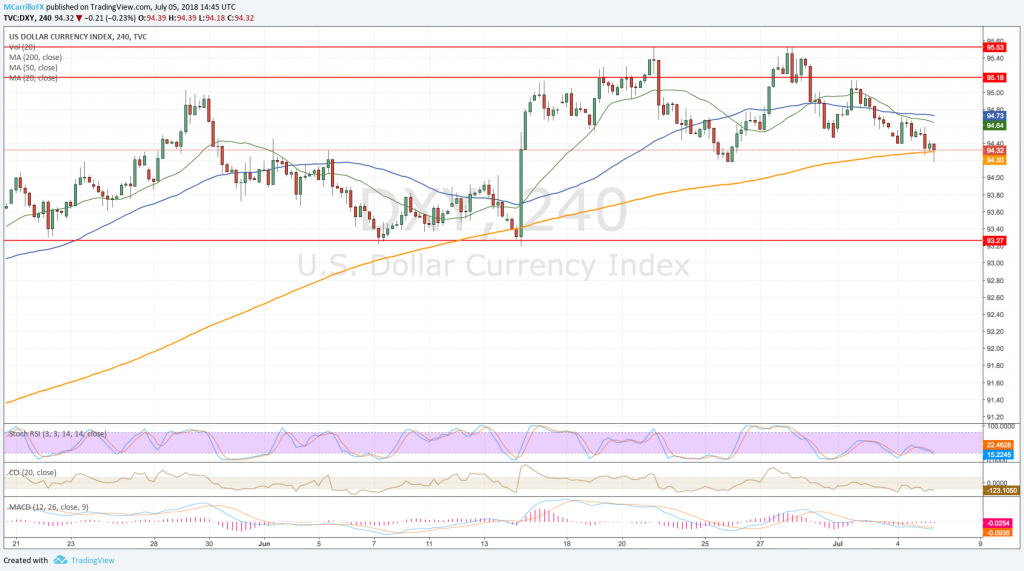

DXY 4-hour chart

The Dollar index reacted negatively to the news coming from the ADP and the department of labor as the DXY fell to 94.20, its lowest level since June 25. The unit is managing to recover some ground and it is trading back at 94.35, 0.22% on the day. The index is fighting to recover ground after the declines posted on the week amid news on ECB and Trump.

Stocks on the rise amid Trump’s ‘friendly’ concessions

Wall Street is trading higher on Thursday as investors are welcoming Trump administration idea to provide European cars with tariffs concessions.

The DJIA rose 113 points at the opening bell, but the index is now off its earlier highs. It is now gaining 0.36% at 24,267.