US Michigan consumer sentiment short of expectations; Dollar down

The Michigan Consumer Sentiment Index declined to 97.1 in July, an unexpected drop from the June figure of 98.2. Market waited for an unchanged index between June and July.

The consumer sentiment remains nearly equal to the average in the last twelve months of 97.1. “The continuing strength has been due to favorable job and income prospects, with consumers under age 45 anticipating the largest income gains since July 2000. So far, the strength in jobs and incomes has overcome higher inflation and interest rates,” the press release said.

In the particular question, the University of Michigan asked people about the negative references to the potential impact of tariffs, “negative concerns about the impact of tariffs have recently accelerated, rising from 15% in May, to 21% in June, and 38% in July (see the chart). Among those in the top third of the income distribution (who account for half of consumer spending), 52% negatively mentioned the impact of tariffs on the economy in early July. ”

Import and export prices offer mixed numbers

Import prices in the United States declined 0.4% in June, well below the 0.1% increase expected by market and the revised 0.9% rose in May. Year over year, import prices rose 4.3%, in line with expectations and at the same growth rate performed in May.

The news said that export prices rose 0.3% in June, more than the 0.2% expected by market but below the 0.6% increase in May. Year over year, Export prices rose 5.3%, less than the 5.7% expected but acceleration from the 4.9% increase of May.

Dollar index reacts to the downside

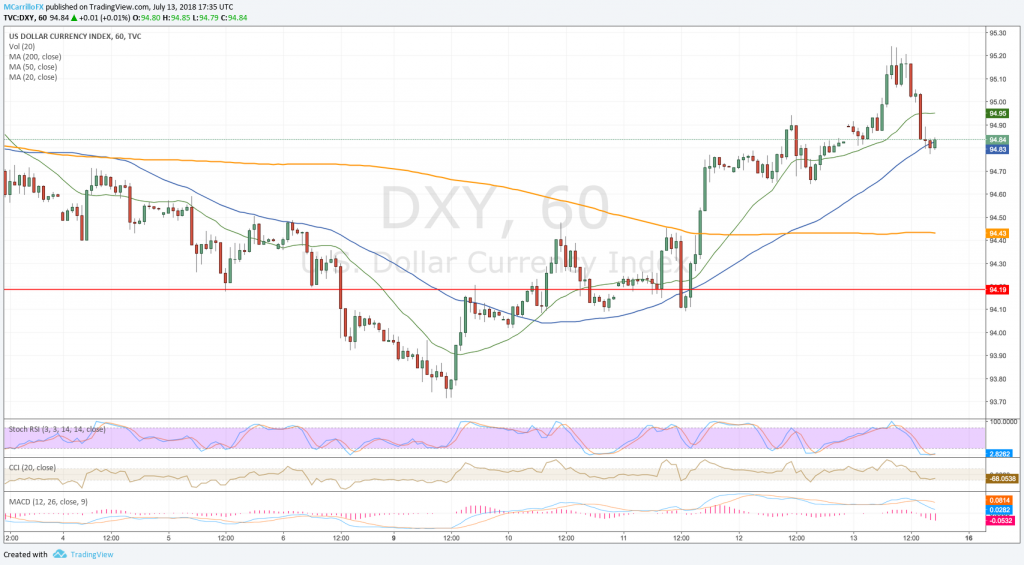

DXY dollar index hourly chart

On the forex sphere, US dollar index reacted to the downside following the disappointing US sentiment data. Post-data, the DXY decline from daily highs around 95.25 to trade at current levels around 94.80, flat on the day.

The EUR/USD traded on recovery mode after bouncing at the 1.1620 area amid US data and profit taking on Friday. The pair is currently trading at 1.1670, flat on the day.

GBP/USD bounced hard from 1.3100 after the sentiment data and the trade tariffs concerns. Cable is currently trading 0.08% positive on the day at 1.3230.