US personal spending sends dollar up; Europe posts higher inflation, but weak GDP

Personal spending and income in the United States rose in line with expectations sending the dollar index up on the day. CPI in Europe pushed the Euro up earlier, but US data dragged EUR/USD down.

News Release Personal Income and Outlays

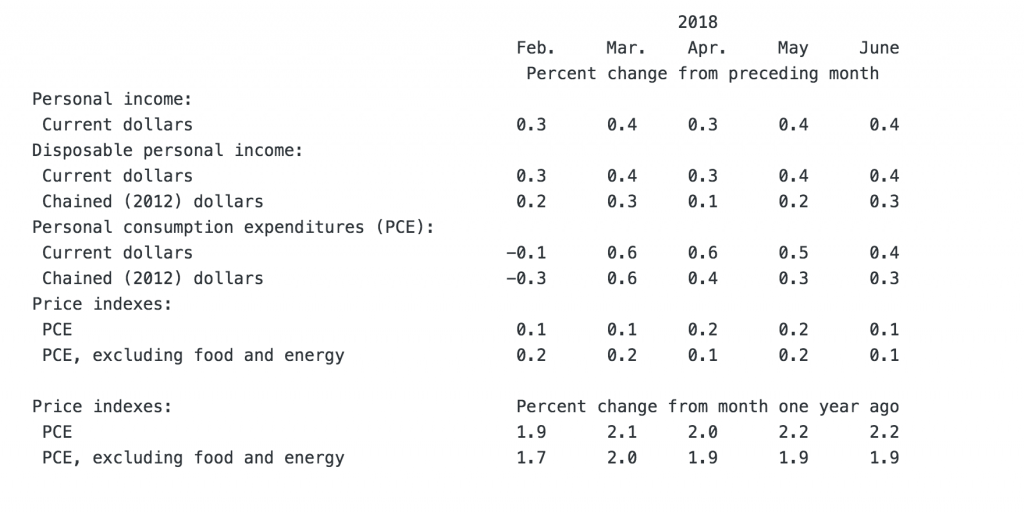

The growth rate for the price index of the core personal consumption expenditure remained at a 1.9% increase in June regarding the same month in 2017. It was a weaker than expected number as the market waited for a 2.0% growth rate.

According to the Bureau of Economics, “The $39.7 billion increase in real PCE in June primarily reflected an increase of $36.4 billion in spending for services. The largest contributor to the increase was spending for food services and accommodations (table 7). Spending for goods increased $1.3 billion.”

Personal income rose 0.4% between May and June, in line of market expectations but a slowdown from May figure of 0.5%. Personal spending rose at the same rate of income with a 0.4% increase in June. In line with expectations but less than the 0.5% posted in May.

“Personal income was revised up $107.4 billion, or 0.8 percent in 2013; $173.6 billion, or 1.2 percent in 2014; $166.6 billion, or 1.1 percent in 2015; $196.4 billion, or 1.2 percent in 2016; and $401.9 billion, or 2.4 percent in 2017.”

Europe posted higher inflation but lower GDP

Europe had a mixed batch of news earlier today as the eurozone gross domestic product rose less than expected in the second quarter, while inflation was higher than market estimates.

Eurozone GDP rose 2.1% in the Q2, a deeper slowdown regarding the 2.2% expected by market and Q1 figure of 2.5%. Quarter over quarter, the GDP rose 0.3% in the Q2, less than the 0.4% expected by experts.

On the other hand, prices in the eurozone rose 2.1% in the last twelve months to July. More than the 2.0% rate expected by market and June numbers.

Dollar index up amid US data

The dollar index is trading positive on Tuesday as investors are betting on the DXY following US GDP data and weak European CPI. DXY is now trading at 94.40.

Earlier in the day, the greenback fell to 94.15 following eurozone CPI prices, but the US consumer-outlays send the index up while almost all USD crosses down.