US stocks open firm as CPI reported as expected and earnings take the focus

Wall Street opened the day with a positive note as investors welcomed inflation data that came in line with expectations and the earnings season is taking center stage. The trade war is still the main topic in the market, but concerns took a break today.

The principal reason for the break in the trade concerns is the lack of retaliation from China after the Donald Trump administration new tariffs announcement of $200-million-tariff for Chinese products.

US inflation rose at the fastest pace in six years. Thought monthly prices came below expectations, yearly inflation and CPI ex-food and energy were reported as expected.

“The all items index rose 2.9 percent for the 12 months ending June; this was the largest 12-month increase since the period ending February 2012. The index for all items less food and energy rose 2.3 percent for the 12 months ending June. The food index increased 1.4 percent, and the energy index rose 12.0 percent, its largest 12-month increase since the period ending February 2017.”

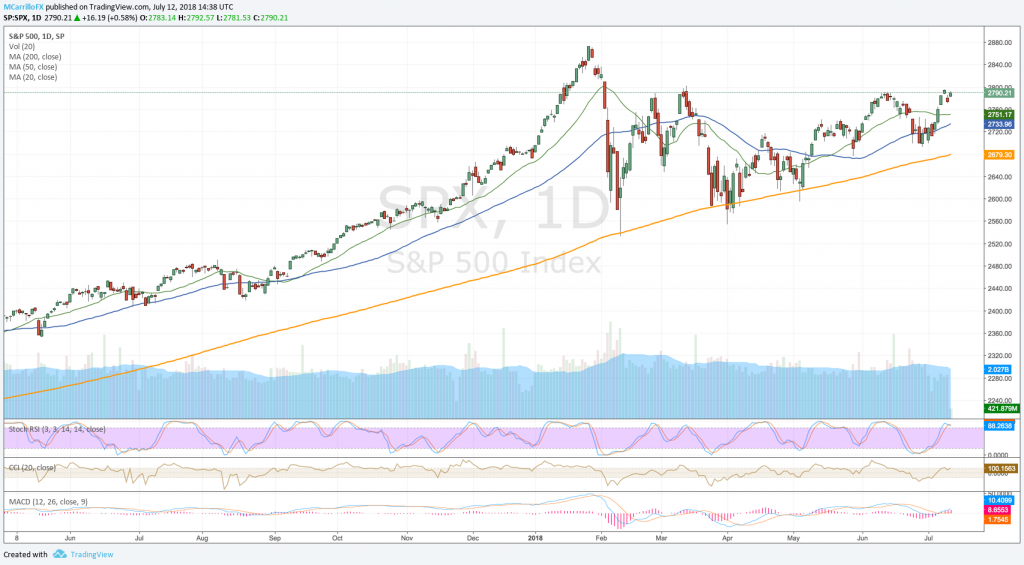

The DJIA is currently advancing almost 150 points or 0.60% n the day, and the index is now trading at 24,850.50. The S&P 500 is ganging 13.80 points or 0.50% to the 2,788.07. The Nasdaq Composite is trading 0.76% up on the day, and it is gaining 58.71 points to 7,775.20.

S&P 500 daily chart July 12

By sectors, information technology is the leader with a gain of 0.73% in the day. Following, the health care sector with 0.51% and the consumer discretionary with 0.30% gains.

Losers are the real estate sector with 0.21% decline; following the utilities with a 0.13% drop and telecommunication services with a fall of 0.11%.

With high volume, stocks that are moving the most are Advanced Micro Devices, AMD with a 2.21% jump in the day to $16.64. Bank of America is trading 0.51% up on the day to $28.83 per share.

The big loser is Broadcom Inc that is collapsing 15.18% just on the day. However, the loss is technical as Broadcom agreed to buy CA Technologies for $18.9 billion in cash. CA is rallying 18.17% to $43.97 today.