USD/JPY up for the third day amid Dollar revival

The US dollar is trading higher against the Japanese Yen on Thursday as investors are welcomed the bounce on the Dollar index at 95.00. The USD/JPY trading positive for the third day in a row.

DXY is trading 0.34% higher on Thursday as the pair is adding 0.33 points to 95.41. The dollar index is bouncing back from the 95.00 area, where the 50-day moving average lies. The Greenback is now trapped between the mentioned moving average and the 20-day MA at 95.50.

On the fundamental sphere, the Nikkei Manufacturing PMI index rose to 52.5 in August, slightly above the 52.4 expected by the market and the 52.3 points posted on July.

However, the leading economic index published a deeper declined than expected at 104.7 points in June, below the expected by market at 105.2. Leading economic index was revised higher to 106.9 in May.

Coincident index in Japan declined to 116.4 in June, below the 116.7 expected by market and the 116.8 posted on May.

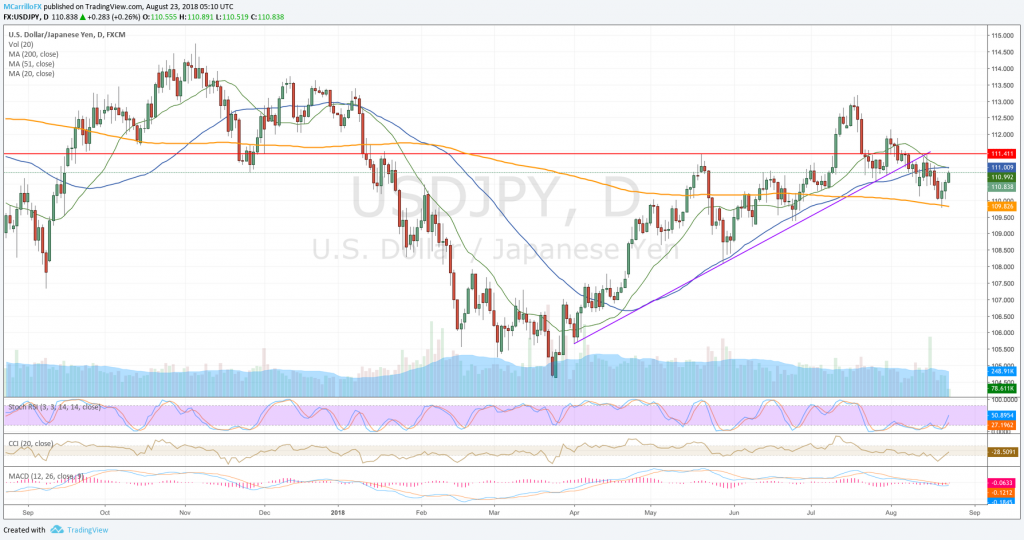

Back to the yen, The USD/JPY is extending its bounce from the 200-day moving average around 109.80 on August 21 as the pair is trading 0.26% positive on Thursday at 110.85. The cross is now testing the 111.00 resistance, where the 20 and 50 days moving averages are in confluence.

USDJPY daily chart August 23

Technical conditions for the USD/JPY are improving. While the MACD is below its midlines, it is improving its numbers and tuning to the north. RSI is showing some recovery, and it is suggesting that the short-term uptrend is healthy.

Oskar Godbole, FXStreet Analyst, said that “having defended the rising (bullish) 100-day MA and neutral 200-day MA support in the previous two trading days, the USD/JPY is looking north and aiming for 111.02 – resistance of trendline sloping downwards from the Aug. 1 high and Aug. 15 high and 50-day MA.”