In an effort to show the great experience you can have trading through the brokership of TenkoFX, they have integrated several promotions.

I will tell you about their newest promotions, but let’s first learn about TenkoFX.

Headquartered in Charlestown, Nevis and operating offshore in Belize, TenkoFX was founded in 2012 as a Forex and CFD broker.

The broker uses the favored MetaTrader 4 downloadable platform. With this platform, traders have various charts, graphs and other tools to make for a great trading experience.

Some have voiced concern with using offshore brokers but rest assured, TenkoFX is licensed and regulated by the International Financial Services Commission of Belize. This commission has instituted tight regulations that brokers must follow.

TenkoFX offers traders a wide class of assets to trade on:

Okay, now here are the various TenkoFX promotions…

The Way Of The Samurai

The idea behind this promotion is to make you a steady thinking Samurai Forex trader. It is simply a monthly contest where you can win from the monthly prize fund by making solid Forex trades.

To enter, you need only fund your TenkoFX trading account with $100 or more and fill out the form on the competition page at the TenkoFX website.

ECN Gravity

This gets you the best liquidity costs in the industry for 3 months after you open an ECN account at TenkoFX.

Just open a new ECN account and deposit $1,000 and message your account manager. You will get 3 months of trading with liquidity costs of just 10 USD per mln.

TenkoFX Cashback Loyalty

For the first 3 months of your new TenkoFX account creation, you will be entered in the TenkoFX cashback loyalty promotion.

No matter if you win, lose or break even, you will get cash back.

To calculate the cash back amount, the standard commission is multiplied by a coefficient, which depends on the total involved margin on the accounts of a particular client.

So you will be in a win/win, lose/win or tie/win position when using TenkoFX as your broker for the first 3 months.

There are 3 promotions giving you a great reason to try out TenkoFX.

Why not try this great broker today? You can go to their website down below and become a TenkoFX Samurai while getting Cash Back doing so.

Prime Promotions At FXPrimusAre you tired of getting a “run around” from brokers?

I’ll tell you up front that a “run around” is not what you will get at FXPrimus. This broker has a great reputation and the testimonials and reviews prove it.

And what’s more, FXPrimus has some great promotions to help you.

Founded in 1999, FXPrimus is owned by the Cyprus based firm, Primus Markets INTL Limited. Being headquartered in Cyprus, FXPrimus is licensed and regulated by CySEC and has also achieved licensing and regulation from the Vanuatu Financial Services Commission.

FXPrimus is well regulated and is known by following all rules and regulations closely.

The company utilizes the downloadable MetaTrader 4 trading platform that provides traders with a fast and well-designed software that gives many features to ensure investors have charts, graphs and indicators to help them profit and win.

The broker offers a huge range of assets in:

I do highly recommend you give FXPrimus a try. These many prime promotions will help:

Until the last day of 2018, FXPrimus will match deposits (100% bonus) up to $10,000. On top of that, they will give $4 cashback on each lot traded. So deposit $500 and you will have $1,000 to trade with.

I mentioned broker “run around” at the start of this post.

FXPrimus has a great deal for you… Just open an account and show FXPrimus how your last broker lost you money. If it is determined that it was not your fault, FXPrimus will reimburse your losses.

How great is that!

Oil is a volatile commodity and it is also a profitable asset if traded correctly.

FXPrimus is one of few brokers who offers oil trading.

You can trade in one of the safest commodities there is at FXPrimus… Gold!

Hedge your trades with some gold and you can feel safer and more secure.

Already a FXPrimus member?

Just deposit $500 and get 30% more to trade with…

It seems like there are ample reasons listed here to scoot over to FXPrimus and start trading.

This highly reputable and secure broker will treat you like a king and not like a slave.

Its no wonder everyone loves FXPrimus… There is nothing to hate… Unless you are in a country that doesn’t allow them.

You can visit FXPrimus at the link below.

Mega Promotions At AmegaIf you are searching for a new broker or just getting started in investment trading, you may want to consider Amega. This broker serves most of Asia and Russia and is considered top rate. Plus, Amega has some mega promotions to help you start off right.

I will tell you about the mega Amega promotions, but let me first tell you about Amega.

Amega is a Russian owned forex and CFD broker who operates from the Marshall Islands.

Amega utilizes the newest Meta Trader 5 platform that the user will have to download. This platform has all the “bells and whistles” with

Meta Trader 5 was designed to give traders the best advantage with trading in the markets.

Amega has 3 account types for you to choose from:

The only questionable concern is… Amega is not licensed or regulated.

First and foremost, you need to know that unlike many other brokers, Amega does not charge any fees or commissions on deposits or withdrawals. That is a huge plus in itself.

100% Bonus For New Traders

Create and account at Amega and deposit from $100 to $1,000 and Amega will give you 100% as a bonus… Deposit $500 and you will have $1,000 to trade with.

There are withdrawal terms that must be met after getting this bonus… You need to make trades using any trading instruments available on the terminal with the total value of 1 lot per every bonus $1 from the time of bonus activation. You have unlimited time to meet the requirements.

50% Bonus On All Deposits

Any time you deposit into your Amega account, they will give you a 50% bonus. It doesn’t matter how often, the 50% bonus is available to all deposits.

Do keep in mind that the same terms are applied… You need to make trades using any trading instruments available on the terminal with the total value of 1 lot per every bonus $1 from the time of bonus activation. You have unlimited time to meet the requirements.

These Mega Amega promotions are a great reason to try this broker.

Keep in mind that Amega has limited service areas. They do not serve EU (Austria, Belgium, Bulgaria, UK, Hungary, Germany, Greece, Denmark, Ireland, Spain, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, France, Finland, Croatia, Czech Republic, Sweden, Estonia) Australia, Canada, Japan, or USA residents.

Be sure and come back and tell us how your trading goes at Amega.

With these bonuses, you should be able to fill your bank account… Happy trading!

Forexee Campaigns You Need To Be Aware OfForexee is a broker that understands if they help you make money, they will also make money. So this broker has instituted various campaigns to get you going.

Founded in 2004, Forexee is owned and operated by NetStock Ltd. and based in St. Vincent and the Grenadines. As such, Forexee is not under any regulatory authority.

The fact that this broker is not regulated should not deter you from trading with them. They have proven themselves trustworthy as I have not found any major negative marks against them. Being in business for 14 years shows that they are operating a safe and secure investing brokerage.

The trading platform Forexee utilizes is the ever-popular MetaTrader 4 that provides traders with a wide array of charts and technical indicators to help you make accurate and wise trades.

The primary assets investors can trade on at Forexee are a huge selection of major, minor and exotic currency pairs as well as CFDs on several cryptocurrencies.

Forexee is both an ECN and a STP broker.

I will explain a little about each campaign and tell you how you can take advantage.

Professional Signals To Try For Free

When you open a Forexee STP or ECN account, you can choose a signal provider from MQL Signal Service and connect to your trading account. Just send the receipt for your signal subscription to Forexee and the broker will transfer the cost for $50 or less on the 1st month of the subscription all to your Ewallet.

Free signals for the first month can help you profit huge.

No Commission Deposit Campaign

If you use bank transfer to deposit $3,000 or more to your Forexee account, Forexee will reimburse the bank’s commission. All you have to do is send Forexee a copy of the bank invoice.

$15 For Your New STP Account

For all new STP accounts opened, just contact live chat and ask for your $15 bonus to get started right trading at Forexee.

Some terms and conditions apply.

Special ECN Trading Commissions

For deposits into ECN accounts, Forexee has a campaign where you will get limited time trading commissions of only $1.

Forexee wants to help you be profitable. If you win, they also win, because you will keep trading and you will also tell your friends about Forexee.

So take part in one or more of their campaigns. You can visit their website below.

Time Is Short – Win An iPhone XI want to apologize to all Investing Online readers… I would have liked to get this news out to you sooner… But you still have time to win an iPhone X from a leading broker.

I will tell you how but first…

Founded in 2007, Amarkets is a world class broker in

Amarkets is headquartered in Montenegro and is licensed and regulated by the Financial Services Authority in Saint Vincent.

Amarkets offers traders the popular MetaTrader 4 platform or you can get more sophisticated and use the MetaTrader 5 platform.

Both offer charts, graphs and much more to give you the best trading advantages.

As for fees, Amarkets gives you options. Traders can choose between fixed or variable spreads, market execution or instant execution, commission free trading or trades with tighter spreads but involve commission.

This contest started on September 1st and runs until the 28th.

For Traders

If you’re a trader, top the list of the most profitable traders or demonstrate the highest trading turnover, and they will deliver an iPhone X to your door.

Here is how…

For Partners

If you are an AMarkets’ partner, attract the largest number of participants to this contest.

The terms are:

Time is wasting… Just click into the AMarkets website below and you can win an iPhone X.

Be sure and come back and tell us when you win.

CoinJar Has Added ZcashFounded back in 2013, CoinJar is a leader in Australia for Bitcoin trading, hodling and spending.

And not only Australia, CoinJar recently moved their headquarters to London and they have been recognized as the international source for cost efficient and secure cryptocurrency transactions.

CoinJar has just announced another great feature that will expand their client base…

CoinJar has added Zcash (ZEC) as another crypto altcoin you can use to trade, save, or spend.

Zcash is loved because of the complete anonymity in that, there are no knowledge proofs since the Zcash blockchain validates transactions without disclosing the data within.

You have many things you can do with Zcash:

So for those who are looking for ways to use their Zcash altcoins, CoinJar is the company you are searching for.

Asher Tan and Ryan Zhou founded CoinJar which was backed by Angel Investors, AngelCube and Blackbird Ventures.

Users have nothing but positives to say about the CoinJar platform. Opening a free account at CoinJar is similar to opening a bank account.

Once you have an account, the purchasing of cryptocurrency is seamless and fast. Plus having the ability to hedge your crypto against major fiat currencies takes away the volatility stress that cryptocurrency carries

CoinJar has been slow and meticulous in adding other crypto coins because they are adamant about security. Ensuring that all users accounts are safe and highly secure has been CoinJar’s top priority.

As time moves forward, we will see CoinJar adding other altcoins.

This is a high quality company that is fair, safe and competent in all their business affairs.

We highly recommend CoinJar and yes, even United States clients are welcome.

You can create a free CoinJar account by clicking their link below.

Have a great day!

Wirex Has Now Added EtherLeading the way in methods for cryptocurrency owners to spend their digital money at various locations worldwide, Wirex has just announced that they have added another cryptocoin to their wallet capabilities.

You see, Wirex has digital wallets for

but users have asked this company to add a feature for Ethereum, and Wirex listened. Just by updating your Wirex app, you can now have the new ETH wallet that will allow you to

When founded by Dmitry Lazarichev, Georgy Sokolv and Pavel Matveev in 2014, the company was known as E-Coin. With a plan of becoming the first company to make it possible for cryptocurrency owners the ability to spend their digital money anywhere and anytime, E-Coin began receiving huge amounts in crowdfunding.

E-Coin was rebranded Wirex in 2017, it is headquartered in London, but also has multiple offices worldwide.

Each cryptocurrency supported by Wirex has its own wallet. When you create a free account, you have wallets for all and you can buy cryptocurrency free of charges.

You can also order debit cards that you can use anywhere that accepts debit cards. Instead of it debiting your bank account, your cryptocurrency wallet is debited.

So with these Wirex supplied debit cards, you can purchase with your Bitcoin, Litecoin, Ripple and now Ethereum.

Wirex does charge fees for debit card usage. ATM withdrawals are $2.50 and Wirex has the highest quality security available to ensure your wallets and debit cards are safe and secure.

No more just staring at your crypto going up and down in value. Now you can use it just like any other currency…

Wirex has made it all possible.

You can simply scroll down and visit the Wirex website to get your wallets and cryptocurrency debit cards.

For United States citizens, Wirex is not yet available, but the administration is working close with American authorities, so hopefully soon!

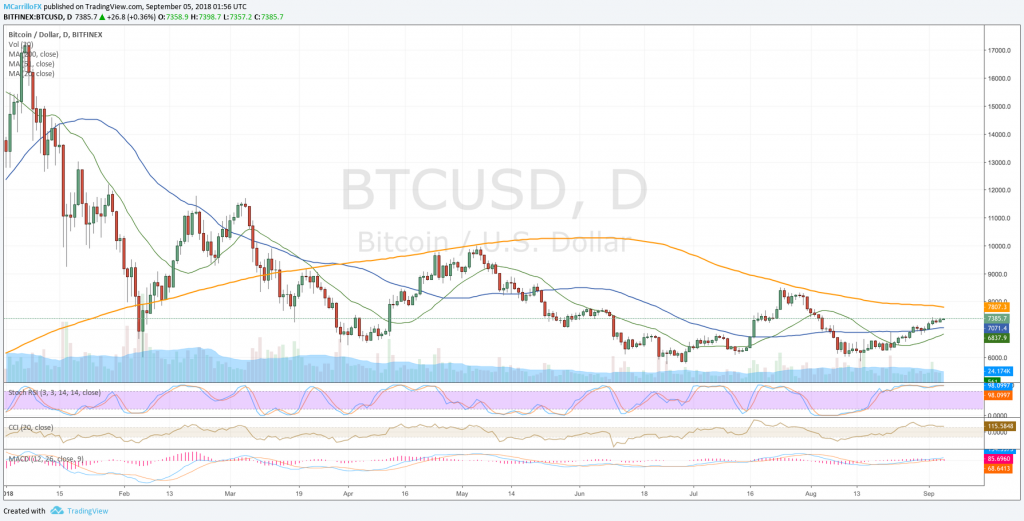

Bitcoin clings to 7,400, technicals favor the upside$100 at a time, bitcoin is gaining ground against all the odds as investors are turning their eyes back to the king of cryptocurrencies. Technical conditions are now bullish, and the scoop is finally for more gains for the first time since January.

BTCUSD daily chart September 4

BTC/USD is trading positive on Wednesday for the fifth day in the last six as the pair consolidated support at 6,880 on the last days of August and it built a leg for a new bullish move that drove BTC/USD to price above the 7,400 level.

Currently, BTC/USD is trading 0.40% positive at 7,390 on Wednesday. Since the August 14 bottom of 5,860, the cross has gained 26% to trade as high as 7,430 this week.

CoinDesk analyst Omkar Godbole affirms that bitcoin is adding indicators signaling a long-term bullish reversal. “The latest to join the list is the MACD histogram, which has moved above zero – turned bullish – for the first time since January. The MACD, which oscillates above and below the zero line, is one of the most popular technical indicators used to determine a trend’s reversal and momentum.”

“So,” Godbole adds, “it seems safe to say that the outlook as per the weekly chart is bullish. As a result, BTC could explore the upside towards the July highs above $8,500 in the next few weeks.”

With BTC/USD trading at 7,390, if the pair extends gains, it will face immediate resistance at the 200-day moving average at 7,800 level. Above there, 8,250 and July’s highs at 8,500.

To the downside, with a rejection of the 7,400 area, the pair will face support at the 50-day moving average at 7,070, and 6,840. Below there, please see for the super support below the 6,000 area.

Wall Street falls on the first trading day of September; trade tensions weightThe US stocks market closed the first trading day of September with losses as investors are concerned about trade conflicts between the United States and the rest of the world. All three major indexes closed down.

Last week, United States announced an agreement with Mexico to replace NAFTA, but another deal with Canada was a conditional for a new NAFTA treaty. Both, the United States and Canada failed to reach an agreement before its deadline, Friday, August 31.

After a long weekend, investors watched how US president Donald Trump intensified its language about trade and added gas to the problem. He even twitted that there was “no political necessity to keep Canada in the new NAFTA deal.”

In this framework, the US stocks market traded depressed on Tuesday. The S&P 500 declined 4.80 points or 0.17% to close the day at 2,896.72. The Dow Jones Industrial Average lost 12.34 points and finished 0.05% down on Tuesday at 25,952.48.

S&P 500 daily chart September 4

The NASDAQ Composite ended the day 0.23% down after losing 18.29 points to 8,091.24. The Russell 2000 lost 0.42% to 7.38 points to finish the day at 1,733.38.

By industries, most sectors finished Tuesday down for the day. The worse performers were real estate with 0.87% loses, followed by consumer staples with a 0.67% decline, and health care with a drop of 0.51% on Tuesday.

The leaders were consumer discretionary with a 0.27% increase, followed by utilities with a 0.09% advance, and industrials with a 0.01% gain.

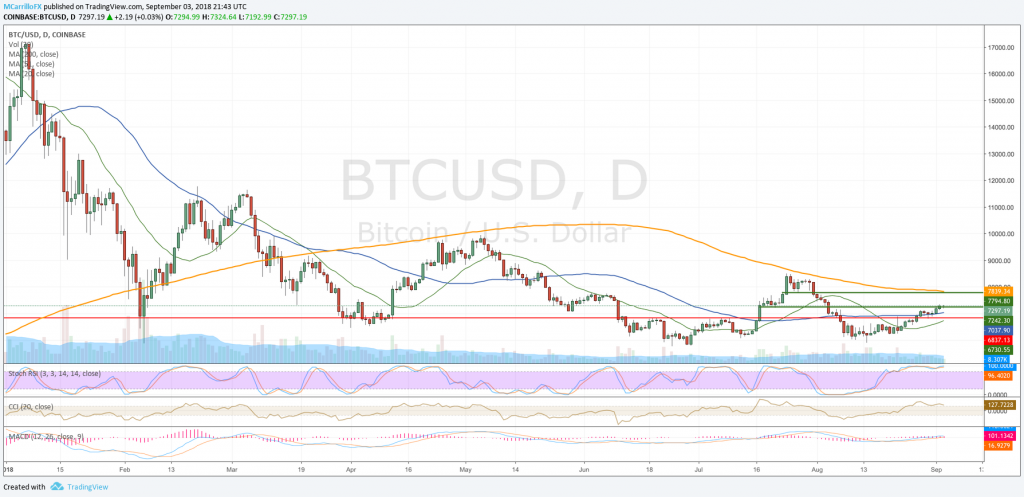

Bitcoin extends advance and tests prices above 7,300Bitcoin is training positively for the fourth day on Monday as risk appetite over the market is helping the cryptocurrency to reach fresh highs. BTC/USD is currently testing the 7,300 level.

After rallying $535 or 7,8% since August 30 lows around 6,790 to Monday highs at 7,330, Bitcoin is trading in consolidation mode just above the critical line of 7,240. It seems market sentiment is again pro-bitcoin as the asset has gained $2,000 in value in less than a month.

Experts around the world believe in the success of cryptocurrencies; specifically, Hermann Finnbjörnsson, founder and CEO of Svandis, said that there is “less than a 1% chance in my mind that bitcoin won’t succeed.”

“I think that there are a lot of reasons to be bullish on bitcoin. Banks are getting into bitcoin,” Finnbjörnsson stated.

So, bitcoin is trading higher, with a 4% gain just in the few days of September. However, the crypto asset remains negative on the year. On Monday, the pair is trading almost flat at 7,290, but it seems BTC/USD has built e new bullish leg after breaking the 6,840 level on August 27 and using it as support on August 30.

BTCUSD daily chart September 3

Technical conditions are now favoring a bullish continuation as MACD is currently above its midlines, while RSI is showing the uptrend is healthy. Moving averages are aligned to the north. Buyers are also protecting the $7,200 support.

To the upside, if BTC/USD consolidates levels above the 7,200 area, it will find immediate support at 7,790. Above there, please check for the 200-day moving average at 7,840. Finally, the last frontier lies at 8,500.

To the downside, if the pair is finally rejected by the 7,300, it will find support at the 50-day moving average at 7,040 and the critical 6,840. Below there, check for buying zones around 6,250.

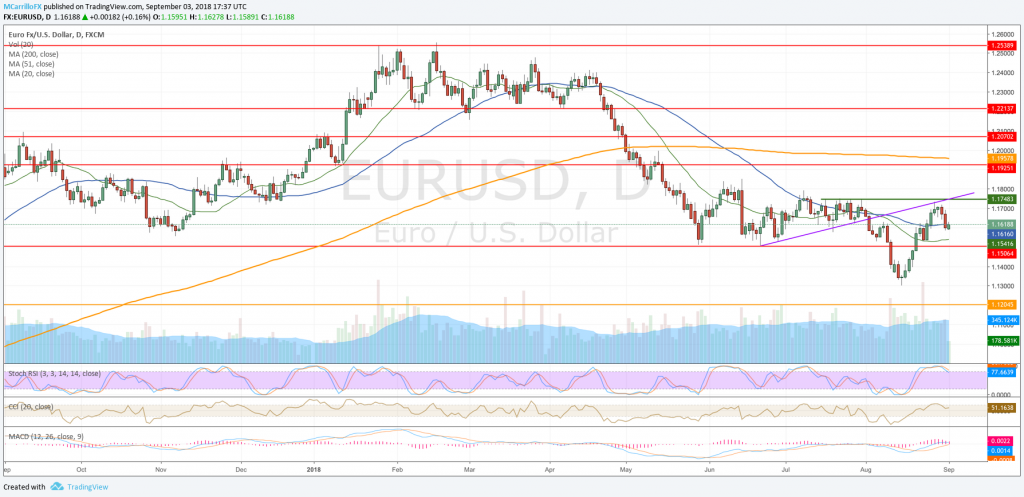

EUR/USD finds support and gets back above 1.1600The Euro is joining the quiet and low volume environment of the labor day holiday in the United States as the EUR/USD stopped a two negative trading day in a row to perform a positive day at the open of a busy week.

Previously on the day, Markit published its European manufacturing PMI reports. The eurozone manufacturing PMI was unchanged at 54.6 between July and August, in line with expectations.

In Germany, PMI manufacturing declined to 55.9 in August from 56.1 in July. It was below expectations as the market waited for the PMI indexes to remain unchanged.

Remember that all figure above 50 indicates expansion while a sub-50 number shows a contraction in the index.

According to FXStreet analyst Pablo Piovano, the dollar lack of direction is allowing the EUR/USD to make some gains, “looking ahead, the pair is expected to remain under scrutiny ahead of Fedspeak and key releases in the US docket, including Friday’s Non-farm Payrolls, while Italy and the German-Italian yield spread appear to have returned to the investors’ radar.”

After falling 130 pips from August 30 at 1.1720 to trade as low as 1.1585 on Monday, the EUR/USD found support at that level, and it is now attempting to consolidate prices above the 1.1600 area.

EURUSD daily chart Sept 3 T

Currently, EUR/USD is trading 0.17% positive on Monday t 1.1620. Technical conditions are neutral with overbought levels in the short term. The pair is still trading in a tight range around the 50-day moving average.

To the upside, if the pair consolidates levels above the 1.1600 price, it will face resistance at 1.1700. Above there, check the 1.1750 critical level. To the downside, if the pair breaks below 1.1685, it will find support at the 20-day moving average at 1.1540 and then, the 1.1500 price.

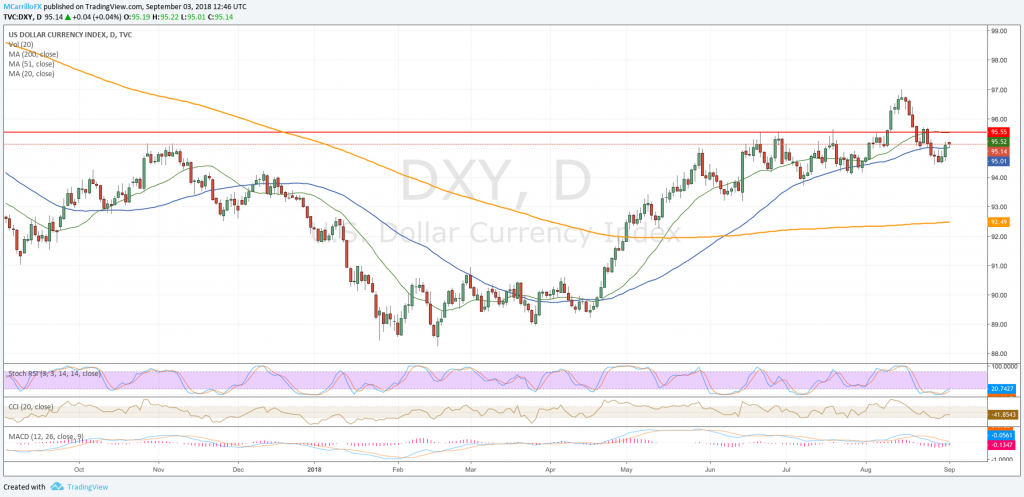

Week ahead: interest rates, PMI, and Nonfarm payrolls to define Dollar fateForex and stocks markets are opening the week with a mixed sentiment and some risk appetite as investors are back from summer vacations. Global trade is the primary concern over markets, the United States failed to reach an agreement with Canada, and it put Mexico’s deal o jeopardize.

Thought Monday is labor day in the United States, investors are looking for a busy week with interest rates in Australia and Canada, while a bunch of PMI indexes that would give market with a business picture around the world.

Finally, nonfarm payrolls will provide the fireworks as the notion that the economy of the United States is on fire could create false expectations.

Overall, dollar is on the defensive while Euro and Yen are making gains. The British pound is under pressure amid Brexit. The greenback seems ready to resume its upside, but everything will be said by trade talks and employment economic data in America.

DXY daily chart Sept 3

Watch the most important event this week:

Tuesday, September 4

Australia: RBA interest rate decision

Switzerland: Consumer price index

United Kingdom: PMI construction

United Kingdom: Inflation report

Canada: Manufacturing PMI

United States: Manufacturing PMI

United States: ISM manufacturing

Wednesday, September 5

New Zealand: Gross domestic product

China: Caixin China services

Spain: Services PMI

Germany: Services PMI

Eurozone: Services PMI

United Kingdom: Services PMI

Eurozone: Retail sales

United States: Trade balance

Canada: Trade balance

Canada: Bank of Canada interest rate

Thursday, September 6

Australia: Trade balance

Switzerland: Gross domestic product

Germany: Factory orders

United States: ADP employment

United States: Jobless claims

United States: Services PMI

United States: PMI Composite

United States: ISM non-manufacturing PMI

United States: Factory orders

Japan: Overall household spending

Friday, September 7

Japan: Labor cash earnings

Australia: Investment lending homes

Australia: Home loans

Japan: Coincident index

Japan: Leading economic index

Switzerland: Unemployment rate

Germany: Industrial production

Germany: Trade balance

Eurozone: Gross domestic product

United States: Nonfarm payrolls

United States: Unemployment rate

Canada: Unemployment rate

Canada: Ivey purchasing manager index

Saturday, September 8

China: Trade balance